Last week we wrote about the first funding source in our four-part series: crowdfunding. This week we explore venture capital, highlighting the growing appetite for coworking investments and some of the recent success stories across the globe.

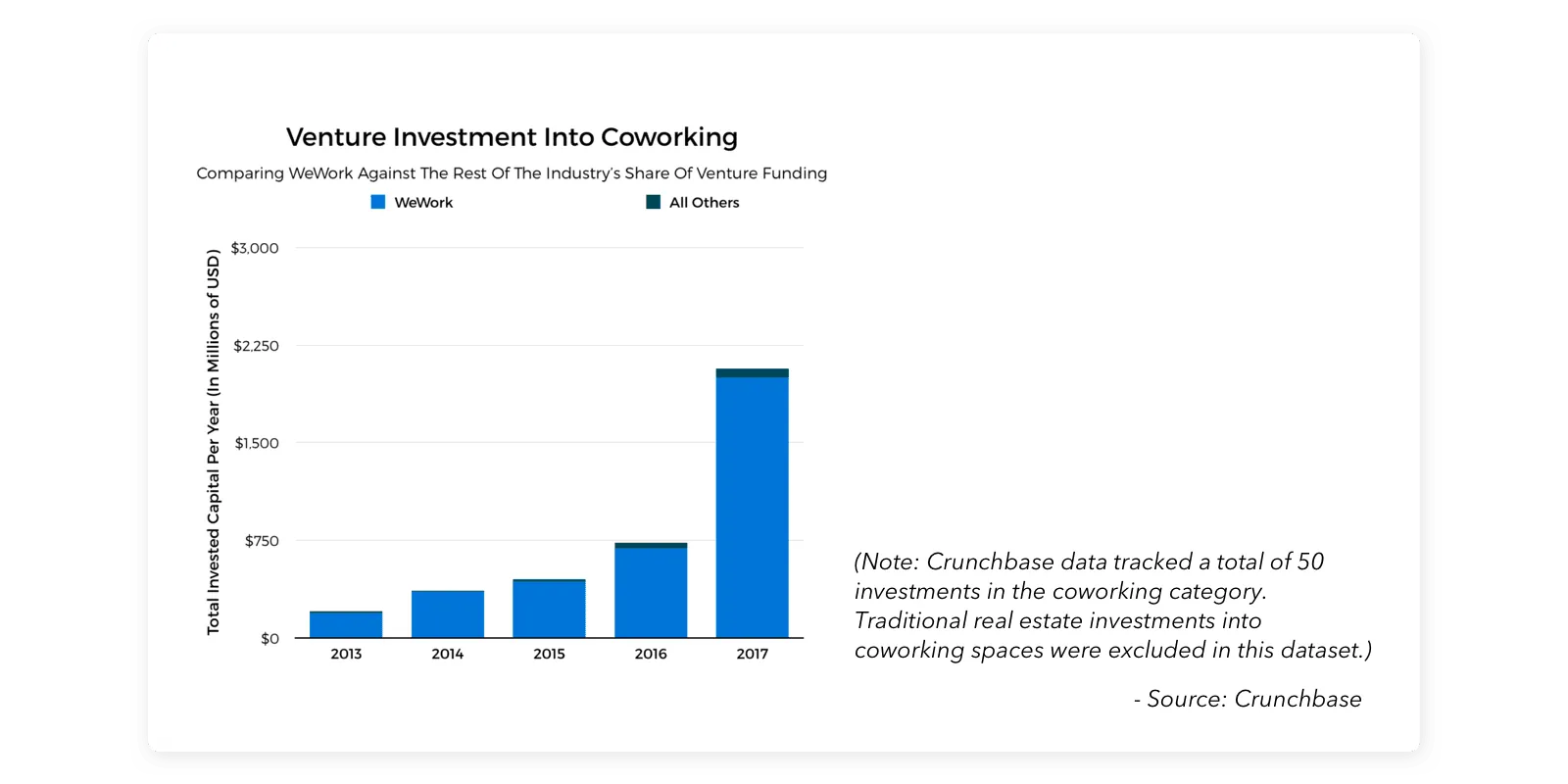

The narrative around venture funding in the coworking industry has been dominated by WeWork for the past few years. To date, WeWork has raised over $8.6B dollars, leading some people to believe that smaller, less established coworking spaces don’t stand a chance at raising venture capital.

However, if you look beyond the WeWork-focused headlines, it’s clear that the appetite for coworking-related investments is quickly increasing. A growing number of coworking spaces with differentiated offerings have ridden the momentous wake of WeWork and succeeded in attracting the capital they needed to expand their operational footprint and grow their community.

Let’s begin with a basic overview of venture capital and how it is relevant in the context of coworking.

Funding Source #2: Venture Capital (VC)

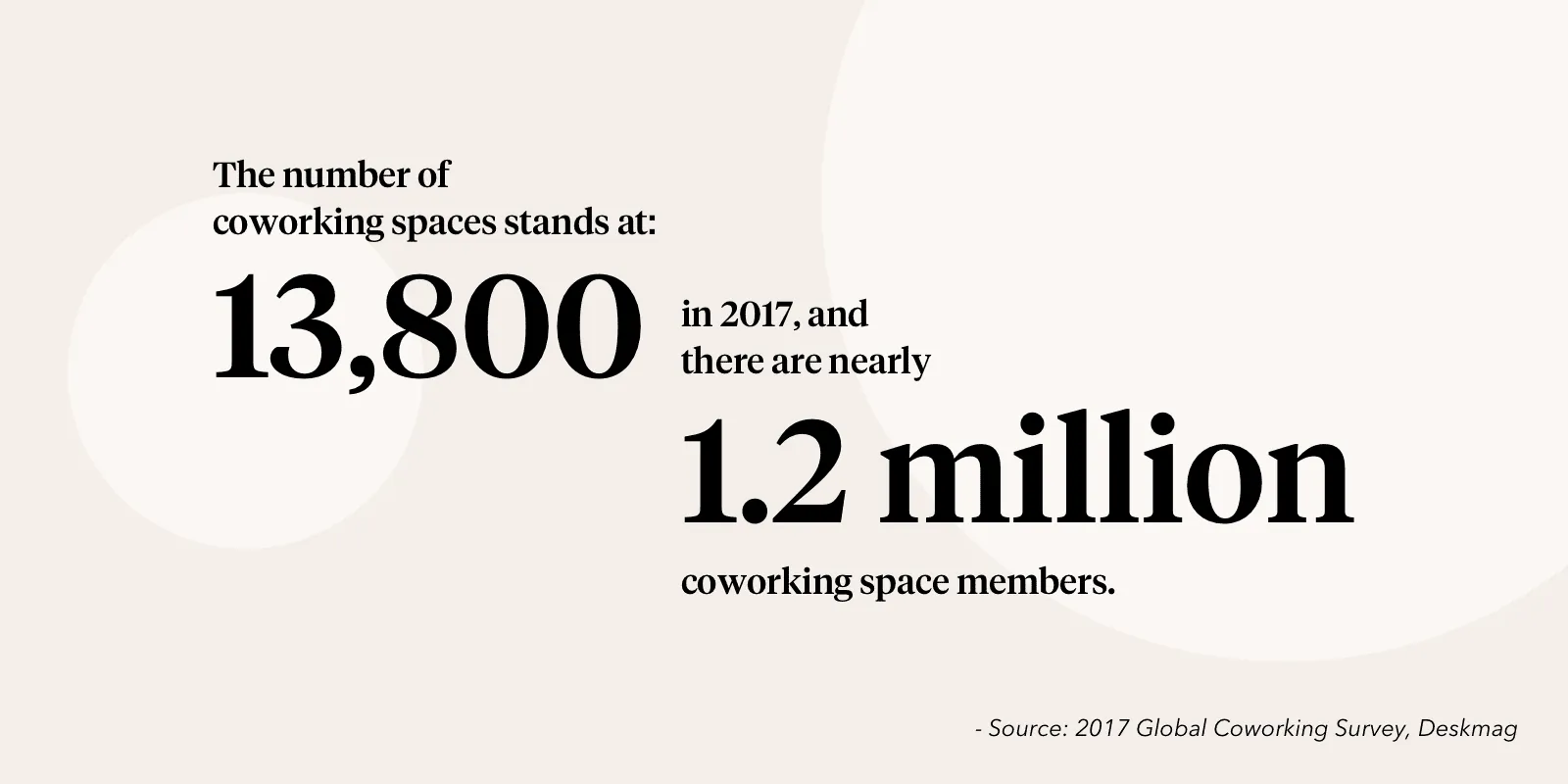

VCs are typically defined as individual investors or a group of investors that provide funding, industry expertise, and access to influential networks in order to support the expansion of a business. Following the meteoric rise of VC investment in WeWork, an increasing number of venture capitalists are turning to the coworking industry in search of opportunities. What’s catching their attention? Rapid growth. According to Deskmag, the number of coworking spaces stands at 13,800 in 2017, and there are nearly 1.2 million coworking space members.

Who has leveraged this funding source?

Every major coworking brand has been known to tap into this particular source of funding – from WeWork to UCommune, Knotel, Industrious, and numerous others. Take, for example, a women-only coworking space, The Wing, which raised $32M this year, or designer-focused Fuigo, which raised $4M in seed funding. Both are great examples of brands that have focused on a niche while carefully developing an unparalleled member experience. And there are many more like them.

Spacemob is another brand that recently raised $5.5M in seed funding from Vertex Ventures. This single-location coworking space in Singapore has ambitious plans of expansion across South-East Asia and hopes that this significant seed round will help fuel that growth. Another Asian-based company, Springboard, was able to raise over $20M from VCs in order to meet the growing demand for coworking in India.

How can I secure this type of funding?

According to Industrious CEO Jamie Hodari, before deciding to pursue venture capital, coworking business owners need to assess what VC funding can do to the structure of their business. Venture capitalists usually offer funds in exchange for company equity; thus, owners need to come to terms with losing a percentage of their business. Hodari emphasizes the importance of clearly defining what the money is intended for, and realize that this sort of funding can take a lot of time to convert.

Another approach to securing this type of funding would be to dive into qualitative research about the types of investments that specific VCs have made in the past, to better understand their investment strategies. A VC that has made several investments in small coworking brands might be more interested in hearing from a coworking owner than a VC interested in high-tech AI companies. Charlie O’Donnell from Brooklyn Bridge Ventures, for example, was interested in The Wing from early on because of a mandate his venture group has around investing in female-led businesses.