TL;DR

- The UK now has 4,199 coworking spaces, with London still dominant but regional cities and rural hubs rapidly expanding.

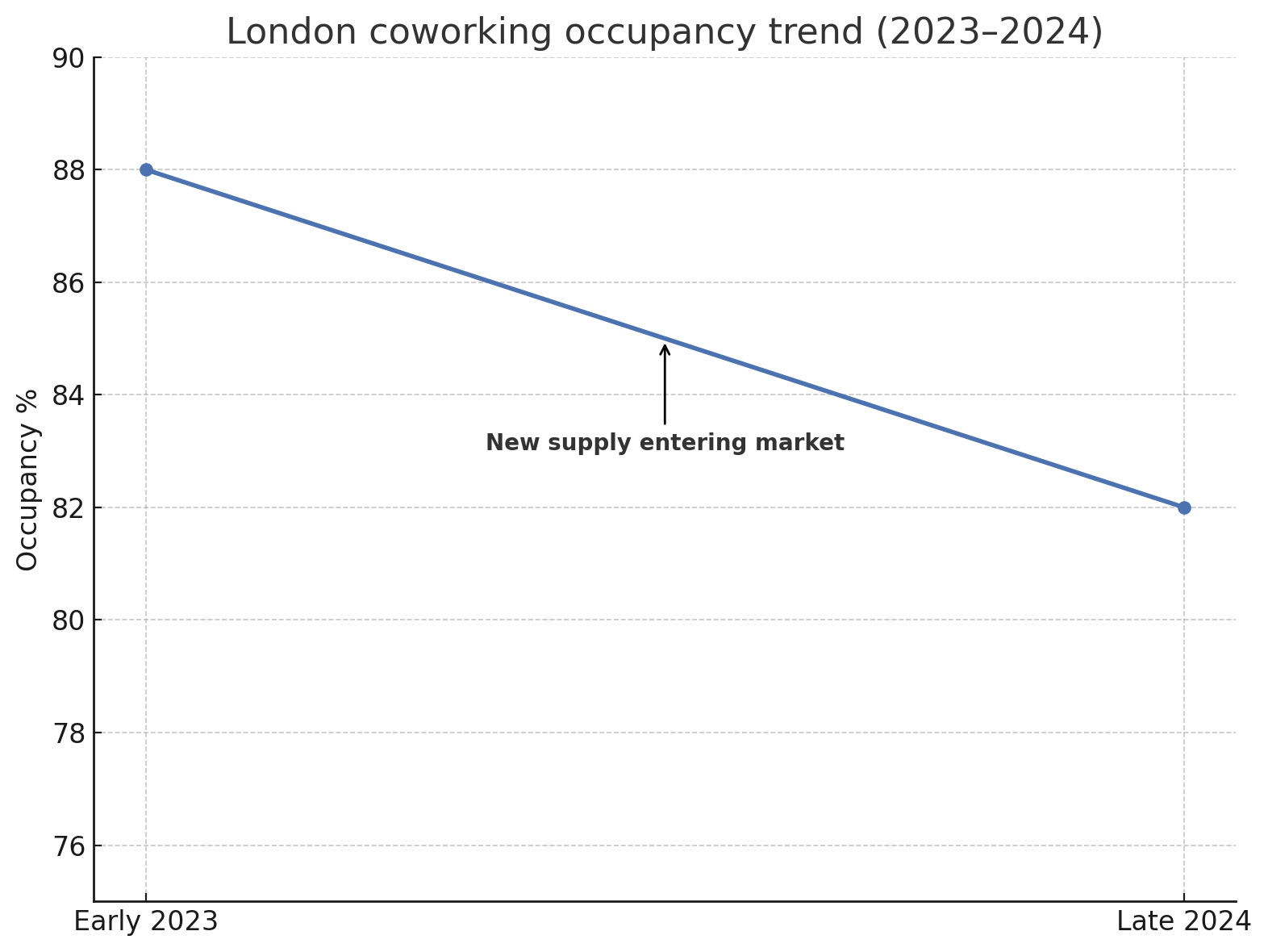

- Occupancy is strong at 80–90%, with London dipping slightly due to new supply but demand holding steady nationwide.

- Contract lengths have grown to 22 months, signaling greater maturity, stability, and confidence in coworking.

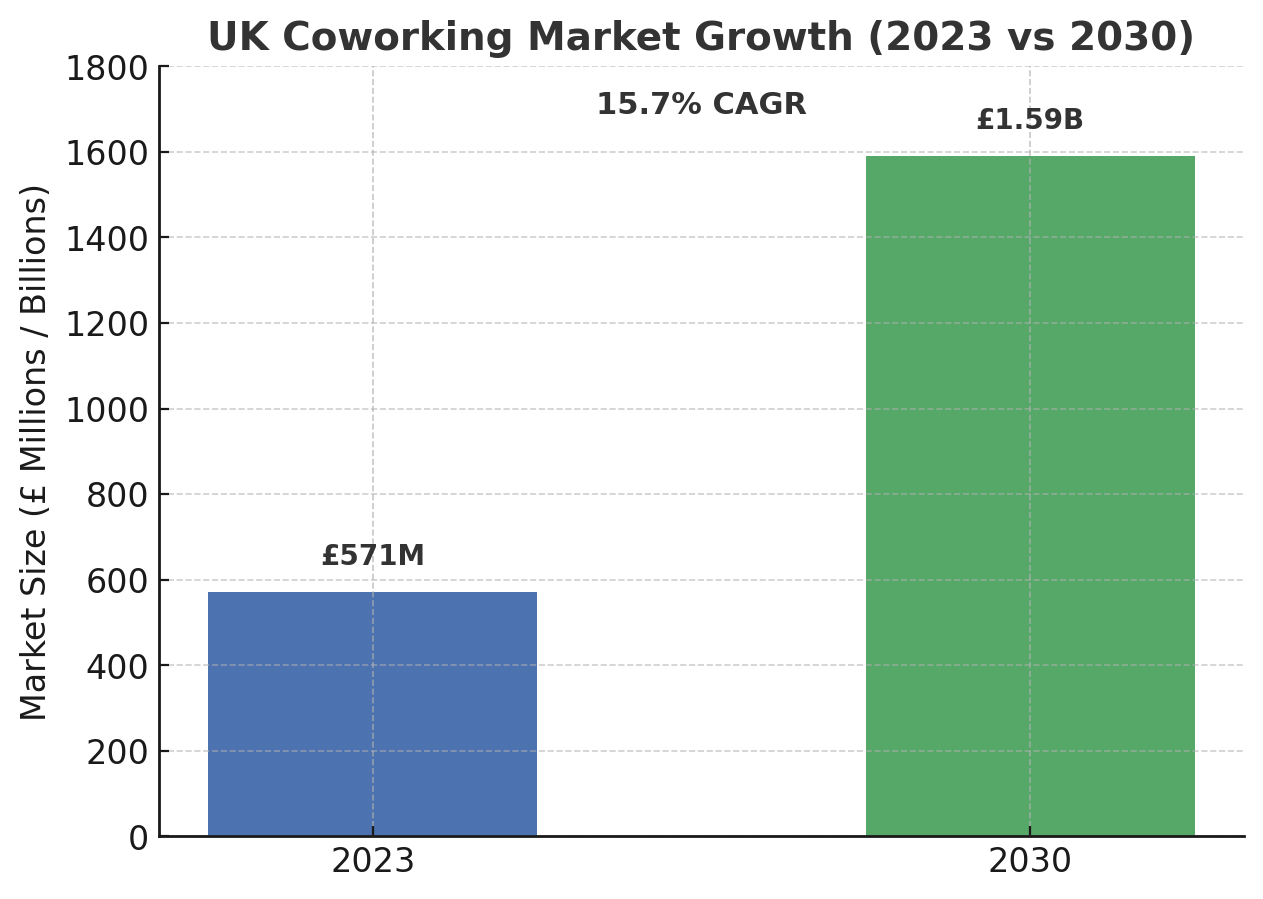

- The market, valued at £571M in 2023, is projected to reach £1.59B by 2030, driven by hybrid work and regional growth.

The UK’s coworking market is in the middle of a growth streak…and there are no signs of slowing down. In 2025, there were just under 4,200 coworking spaces across the UK. London still dominates, home to nearly 30% of these spaces, but regional cities like Manchester, Birmingham, and Bristol are rapidly expanding their footprints.

For operators, these figures reveal where demand is strongest and how member behavior is shifting. Much like the US coworking industry, regional hubs and even rural towns are emerging as high-potential markets.

In this article, we’ll break down the key benchmarks for the UK coworking industry – from supply growth and pricing to occupancy trends – so you can see exactly where the market stands today and where it’s headed next.

At-a-glance UK coworking stats:

- How many coworking spaces are there in the UK?

- How does coworking differ across cities in the UK?

- Occupancy rates and demand patterns in UK coworking spaces

- Average contract length in UK flexible workspaces

- UK coworking market value and forecast

- Coworking prices in the UK: London vs. the rest

- Key takeaways for UK based coworking space operators

How many coworking spaces are there in the UK?

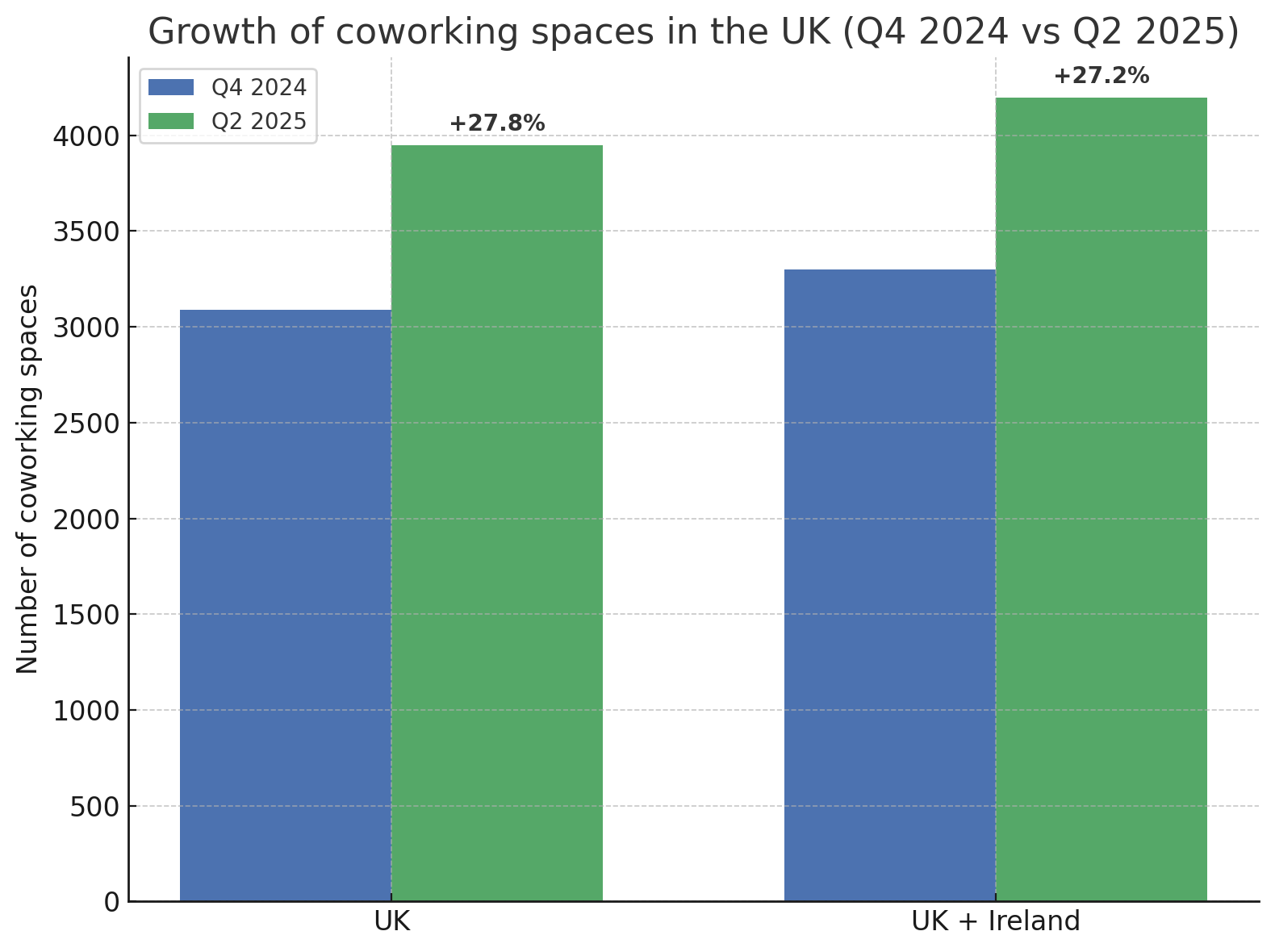

As of Q2 2025, the UK alone hosts 3,949 coworking locations, with the broader UK and Ireland totaling 4,199 flexible workspaces. This is a testament to the sector’s rapid expansion and maturity. In previous years, the UK had around 3,090 spaces (end of 2024), and across the British Isles, hit 3,300+ combined, highlighting the significant growth in just one year.

How does coworking differ across cities in the UK?

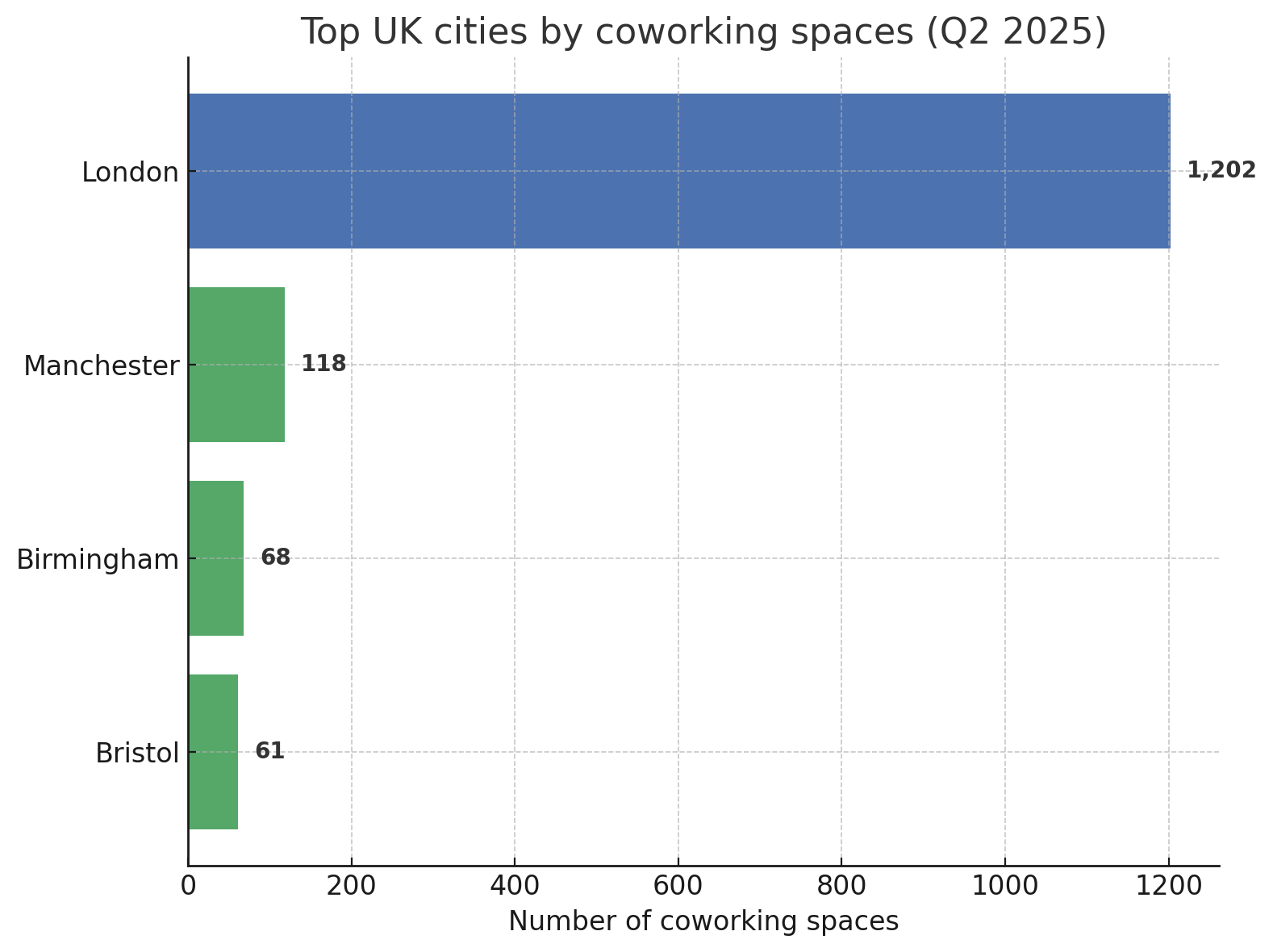

Greater London remains the unrivaled leader in the UK’s coworking landscape. As of Q2 2025, the capital hosts 1,202 flexible workspaces, accounting for over 30% of the country’s total coworking inventory, a clear marker of its continued dominance .

Beyond the capital, several cities stand out for their coworking presence:

- Manchester: 118 spaces

- Birmingham: 68 spaces

- Bristol: 61 spaces

These cities reflect growing regional hubs, drawing demand from startups, freelancers, and satellite teams of larger enterprises seeking more affordable alternatives to London without compromising access to talent or infrastructure.

Rural and small-town coworking growth in the UK

Rural and small-town hubs are emerging to serve professionals who have relocated from London and other major metros. This shift aligns with the UK government’s “levelling up” agenda, which promotes economic activity across the country.

Manchester, Birmingham, Leeds, and Bristol are now priority markets for major operators and investors, driven by:

- Lower operating costs compared to London

- Strong demand from startups and SMEs

- Increased use of satellite offices by corporate teams

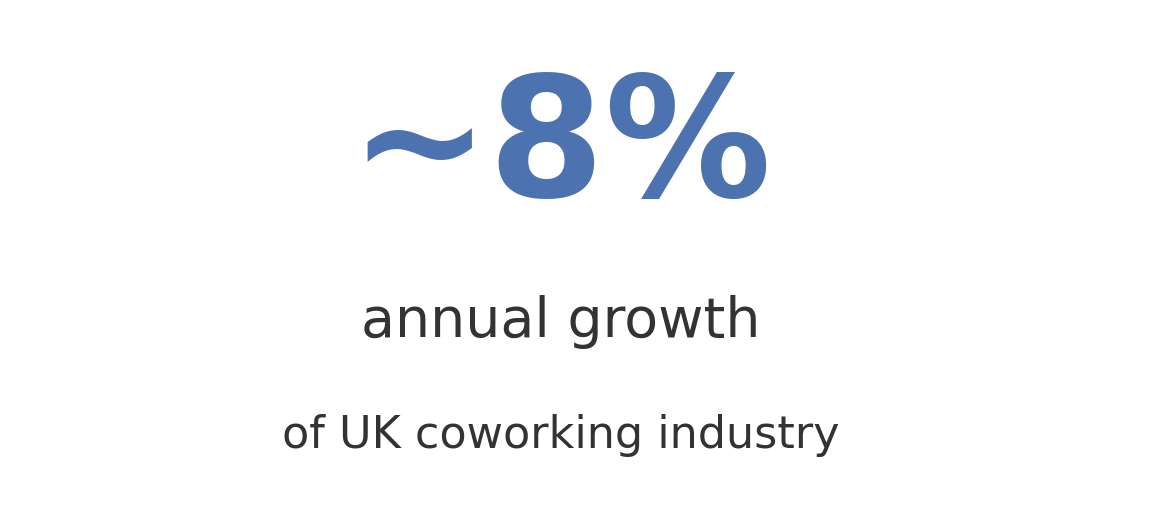

According to market forecasts, the UK coworking sector is expected to grow in value by 7–8% annually through the mid-2020s, with regional expansion a major driver.

For operators, this means thinking beyond the capital to tap into the next wave of demand.

Occupancy rates and demand patterns in UK coworking spaces

Occupancy levels in the UK coworking market remain impressively high, especially among well-established spaces. By mid-2024, many mature locations were operating at 80–90% capacity, underscoring strong demand across both London and regional hubs.

London’s occupancy dip: supply growth in action

London’s average occupancy slipped from 88% in early 2023 to ~82% in late 2024. This dip is a byproduct of significant new supply entering the market. In other words, the capital’s coworking demand remains strong, but it is being temporarily diluted as fresh inventory becomes available.

Regional resilience

Regional coworking hubs are also seeing healthy occupancy rates, though often slightly lower than London’s top-tier spaces due to greater supply elasticity. In cities like Manchester, Birmingham, and Bristol, demand is fueled by:

- Startups seeking affordable alternatives to London rents

- Corporate teams using satellite offices for distributed work

- Local entrepreneurs and freelancers seeking community and resources

Average contract length in UK flexible workspaces

One of the clearest signs that the UK coworking market is maturing is the rise in average contract lengths. As of 2025, flexible workspace agreements in London now average 22 months, the longest since CBRE began tracking the metric in 2020. This marks a significant shift in an industry once defined by short-term, month-to-month commitments.

Why are contract lengths for coworking spaces increasing in the UK?

Several factors are driving this change:

- Greater occupier confidence: businesses see coworking as a long-term workplace solution rather than a temporary stopgap.

- Hybrid work planning: companies are locking in space to support a consistent schedule for their distributed teams.

- Market competition: in high-demand areas like London, committing for longer can secure better pricing and availability.

What is the impact of longer contract lengths on operators?

Longer agreements provide operators with more predictable revenue and help smooth occupancy fluctuations. They also create opportunities for upselling additional services such as meeting room packages, event hosting, and virtual mail add-ons over the life of the contract.

What is the impact of longer contract lengths on members?

For members, signing longer deals often means better stability, especially in markets where competition for prime locations is high. This is particularly true in London’s central business districts and in smaller regional hubs with limited premium inventory.

The UK coworking sector is shifting from a transient model toward longer-term commitments, benefiting both operators (stability and forecasting) and members (security and pricing advantages).

UK coworking market value and forecast

The UK coworking sector is growing in its footprint and its financial weight. In 2023, the market was valued at £571 million, and forecasts project it will reach £1.59 billion by 2030. That’s a compound annual growth rate (CAGR) of 15.7%.

Flexible offices (including coworking spaces) currently account for around 2.5% of total office stock in Europe, with the UK closely mirroring that figure. This share is steadily rising as more occupiers choose flexible solutions over traditional leases.

Drivers of market value growth

- Regional expansion: beyond London, cities like Manchester, Birmingham, and Leeds are seeing strong demand from both startups and corporate satellite offices

- Government support: the UK’s “levelling up” agenda encourages distributed economic growth, fueling coworking uptake in regional and rural markets

- Hybrid work adoption: companies are using coworking to complement home working, reducing long-term lease commitments while keeping physical hubs

If the projected growth trajectory holds, coworking could capture a significantly larger slice of the UK office market by the end of the decade—driven not only by higher occupancy and contract lengths, but also by rising prices in key markets like London. This pricing trend is what we’ll explore next.

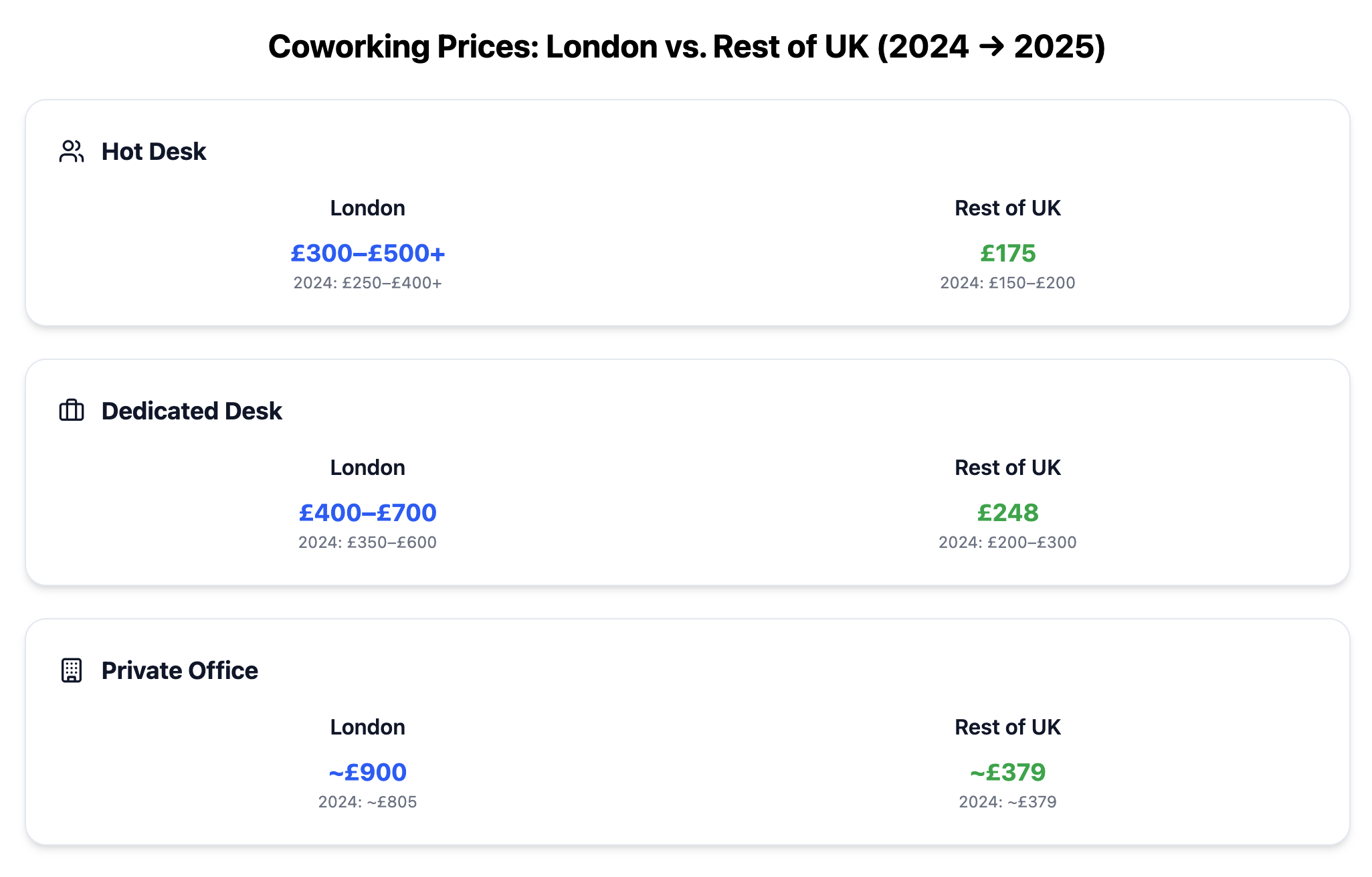

Coworking prices in the UK: London vs. the rest

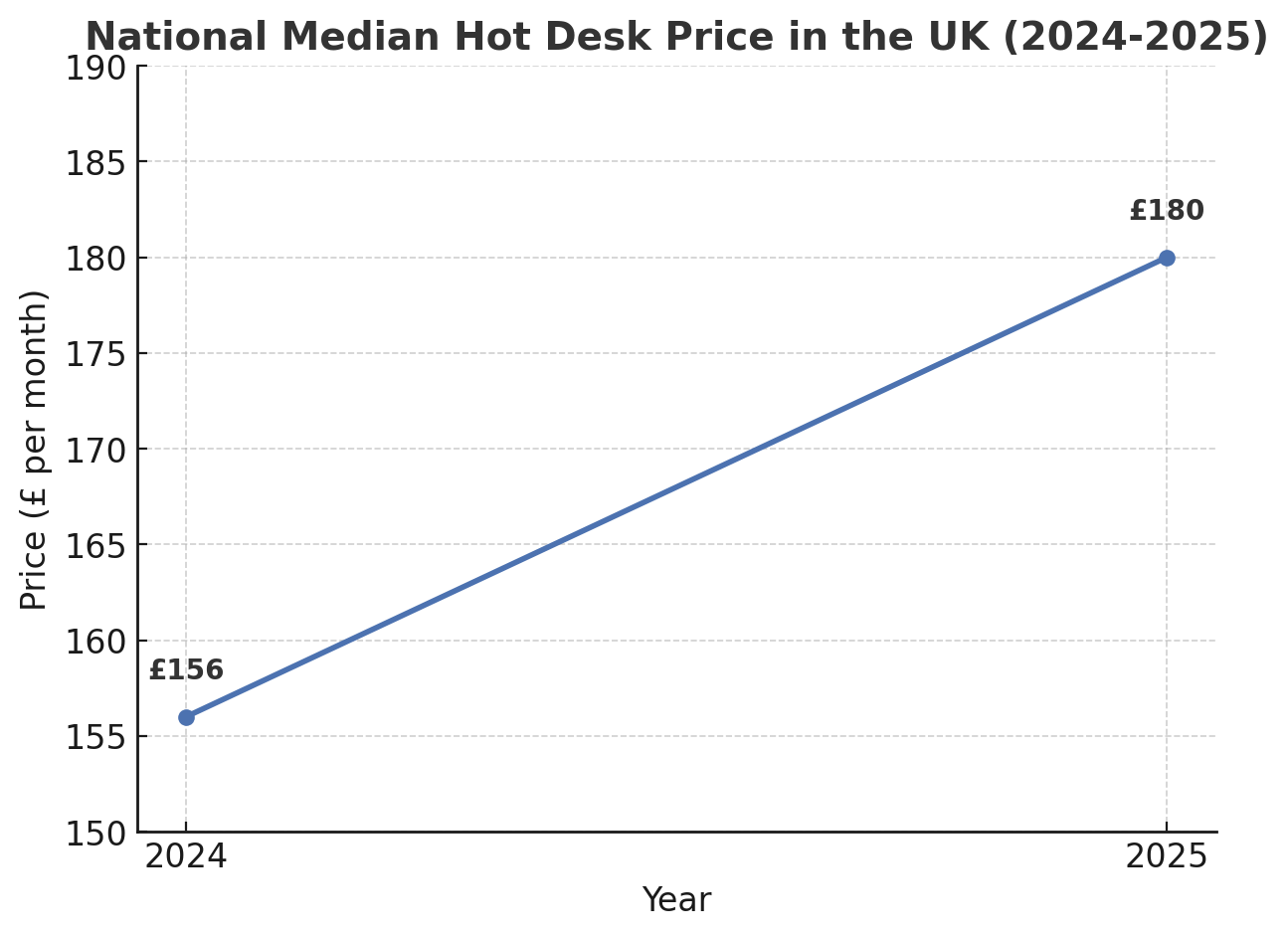

Coworking prices in the UK continue to show sharp regional variation, with London holding firm at the premium end of the spectrum. As of Q2 2025, the national median monthly price stands at £180 for a hot‑desk membership, notably higher than the £156 seen in 2024, and £248 for a dedicated desk, reflecting rising demand and market maturity.

London coworking prices

London remains the priciest coworking market in the UK—and one of the most expensive globally. As of 2025:

- Private office: around £900 per desk/month in central locations, particularly in the West End and City of London. It’s a notable increase from 2024 averages

- Hot desk memberships: generally range between £300–£500+, with the most in-demand districts (like Mayfair, Soho) at the top of that scale

- Dedicated desks: typically fall between £400–£700/month, depending on service levels and facilities

- Ultra-premium options such as team suites in iconic addresses (ie. Canary Wharf, Knightsbridge) now regularly run into the low thousands per month

For context: in 2024, the likeliest cost for a private office was ~£805 per desk/month, hot desks were £250–£400+, and dedicated desks ranged between £350–£600. In 2025, the elevated figures reflect ongoing demand pressure, limited supply in central areas, and growing appetite for premium hybrid-ready work environments.

Regional coworking prices

Outside London, coworking prices drop noticeably—but there’s still notable variation across the UK. As of 2025:

- Dedicated desk (national median): ~£248 per month

- Open workspace/hot‑desk membership (national median): ~£175 per month

Brighton & Hove are among the priciest locations outside the capital. Dedicated desks average £300 per month, while open workspaces hover slightly below London levels. For context, in 2024 the figures were broadly:

- Private office (national average outside London): ~£379 per desk/month

- Hot desks: ~£150–£200 per month

- Dedicated desks: ~£200–£300 per month

These updated 2025 medians, £175 for hot desks and £248 for dedicated desks, reflect a noticeable upward shift in baseline pricing outside the capital, driven by rising demand even in regional markets.

Rural and small-town coworking prices

In rural and suburban areas, prices can be dramatically lower. Hot desks under £100/month are common, often offered by small operators or cooperatives catering to local freelancers, remote workers, and microbusinesses.

While these spaces may operate on smaller budgets, they often trade on community appeal and hyper-local networking.

Key takeaways for UK based coworking space operators

The UK coworking market in 2025 is defined by rapid expansion, maturing demand, and increasingly nuanced regional dynamics. Whether you’re running a space, investing in the sector, or choosing where to work, the data points to several clear opportunities.

- Think beyond London: while the capital remains a lucrative market, growth in Manchester, Birmingham, Leeds, and Bristol offers strong potential at lower operating costs.

- Leverage longer commitments: the rise in average contract length to 22 months means more predictable revenue streams.

- Prepare for pricing differentiation: London’s premium price supports higher service levels and brand positioning, but regional markets may require competitive pricing and tailored amenities.

- Capitalize on hybrid work trends: flexible memberships and satellite office models are attracting corporate clients, design packages that cater specifically to this demand.

The UK coworking industry is maturing into a stable, diverse market. For operators, the playbook now extends beyond simply filling desks—it’s about targeting the right locations, securing longer commitments, and offering differentiated value.

Are you a UK-based coworking space operator looking for a way to automate your coworking space and improve profitability? Get in touch with Optix.

Operating a coworking space in the UK? Let's chat.

Frequently asked questions

As of Q2 2025, the UK hosts 3,949 coworking spaces, with the broader UK and Ireland totaling 4,199 flexible workspaces. London leads with over 1,200 spaces, but regional hubs like Manchester, Birmingham, and Bristol are experiencing rapid growth.

Beyond London, Manchester (118 spaces), Birmingham (68 spaces), and Bristol (61 spaces) are the leading coworking cities in 2025. These regional hubs are attracting startups, SMEs, and corporate satellite offices thanks to lower costs and strong talent pools.

Coworking spaces in the UK maintain strong occupancy, averaging 80–90% in 2025. London’s occupancy dipped slightly to ~82%, not due to weaker demand but because of new supply entering the market. Regional hubs like Manchester and Bristol are also performing strongly.

The average coworking contract length in London has grown to 22 months in 2025, signaling a maturing market. Longer commitments provide stability for members and predictable revenue for operators, moving coworking beyond its short-term, flexible-only reputation.

The UK coworking market was valued at £571 million in 2023 and is projected to reach £1.59 billion by 2030. This growth is fueled by hybrid work adoption, regional expansion, and longer contract commitments from occupiers.