Summary

- Accounting software is an online, typically cloud-based, solution that helps coworking businesses automate their day-to-day financial operations

- Important features to consider include financial reporting, budgeting, and expense tracking

- Two great options for coworking spaces include Xero and Quickbooks

Keeping track of your cash flow is a top priority for every business.

It’s nearly impossible to grow your coworking space without a clear understanding of what’s owed to you, what’s owed by you, and what’s been paid.

Yet staying on top of accounting can be tricky, especially for coworking spaces just starting out.

This is where accounting software can make a big difference.

This post will outline the most popular accounting software options for coworking spaces, as well as key factors to pick the best one for your coworking technology ecosystem.

What is accounting software?

Accounting software is an online, typically cloud-based, solution that helps coworking businesses automate their day-to-day financial operations.

A good accounting software can help you with:

- Logging expenses

- Creating invoices

- Tracking cash flow

- Managing taxes

Most importantly, it can save you valuable time and money when implemented correctly. For that reason, most coworking businesses looking to scale consider accounting software to be a non-negotiable.

Accounting software vs. payment gateways

It’s worth noting that accounting software is not the same thing as a payment gateway.

Payment gateways like Stripe allow you to accept payments online, while accounting software helps automate your bookkeeping tasks. They are compatible, but completely different.

Most coworking spaces will benefit from (and will most likely need) both.

What account software features are most important to coworking spaces?

Accounting software does more than just invoicing. Here are a few key features to look out for as you explore which software is best for your coworking space.

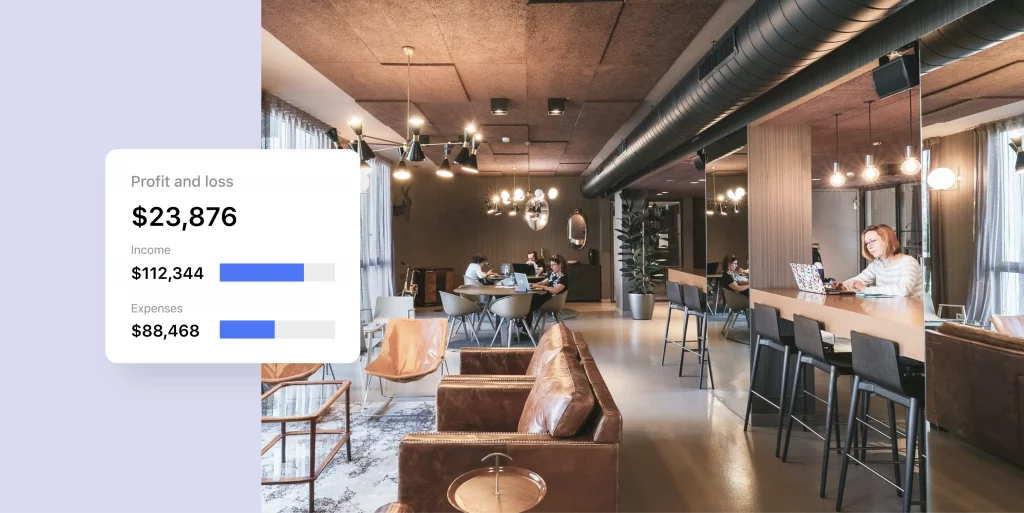

1. Financial reporting

Keeping track of your business health can be tricky.

Good accounting software will use the data it collects to develop comprehensive financial reports for your business – such as a cash flow, profits and losses, and balance sheet report.

This way, you can take a step back and see the big picture when it comes to your business.

2. Budgeting

Budgeting is important in maintaining the financial health of your company. Many accounting softwares offer budgeting tools to help you track your budget against performance.

While you may already have a budget sitting in a spreadsheet, budgeting within your accounting system can simplify implementing and tracking your budget by automating much of the process for you.

Some software even provides real time updates on how you are performing relative to your budget, making it easier than ever to keep track of your finances.

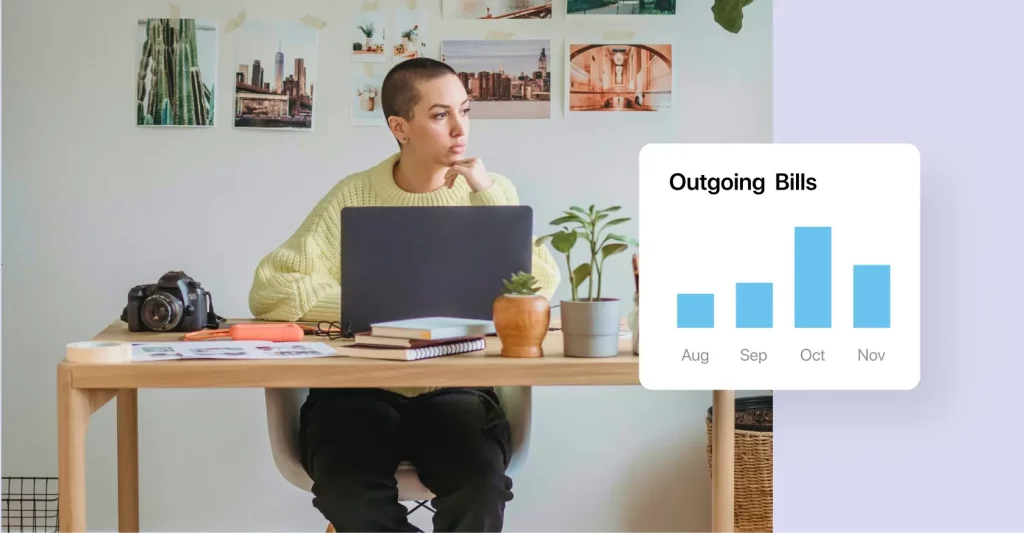

3. Expense tracking & accounts payable

Tracking the money going out is just as important as tracking the money that’s coming in.

Some accounting software allows you to set up your vendors and schedule regular payments.

By doing this within your accounting software, this information can feed automatically into your financial reporting to give you accurate, real time snapshots of your financial position.

4. Accounting on the go

If you want to be able to manage your accounting from anywhere, then you’ll need a good mobile app.

Make sure your chosen solution offers an optimized mobile app experience. That way, you can send and track invoices, view reports and capture business expenses – wherever you are.

5. Support services

Sometimes issues occur. Don’t forget to review the customer support options your solution offers.

Do they have a live chat? A 24/7 phone line? What about a good help center or community forum? Having these can be invaluable if things go wrong.

What is the most popular accounting software for coworking spaces?

One of the biggest challenges when looking for accounting software is narrowing down options.

There are many solutions available, each one with its own unique benefits. Some that we see coworking operators use the most include:

However, two choices consistently come out on top: Xero and Quickbooks Online.

Xero accounting software for coworking spaces

Xero is a cloud-based accounting software made for small and medium-sized businesses.

It’s known for its user-friendly interface and robust feature set, most of which are included in all of their plans. This includes:

- Tracking and paying bills

- Claiming expenses

- Accounting reports

- Sending invoices

Their wide range of features is a big advantage, as many solutions reserve top features for their premium packages.

Coworking operators love Xero because it’s easy to use, affordable for small spaces, and it integrates with your coworking management software.

QuickBooks accounting software for coworking spaces

QuickBooks is another popular cloud-based option that coworking spaces love.

It comes with a strong financial forecasting functionality to track the health of your business, as well as lots of time-saving features which it estimates saves users 40 hours a month on accounting tasks.

Not to mention, Quickbooks also integrates with most coworking software, making it a popular choice for operators.

Integrating your accounting software with your coworking management software

Perhaps the most crucial consideration when choosing an accounting software is the ability to integrate with your coworking software.

If you don’t already have a coworking software in your space, this guide will help you choose the best one.

A solid integration is essential for the efficiency of your entire operation. Almost all coworking software has some integration capability with an accounting system, but simply having an integration doesn’t mean it does everything you need.

Here are some good questions to ask to help you evaluate if your coworking software and accounting software can work well together:

1. Does the integration support automatic user creation in the accounting system?

This can be a real time saver when onboarding new members.

Ideally you should be able to add your members into your coworking software and have them automatically created in your accounting system. No more double keying user details in various systems!

2. Is the sync one-way or two-way? Is it automatic or manually triggered?

A two-way payment sync is a necessity as it will allow your information to be updated in either system while giving you the confidence that your records are accurate.

Ideally, this should also be automatic so you don’t have to worry about manually triggering a sync any time you’ve updated an invoice.

3. Can you link memberships/rooms with ‘Accounts’ in the accounting system to allow for automated categorization of revenue?

Understanding where your revenue is coming from is likely a top priority.

By linking accounts to products and services in your coworking system, you can be sure revenue is being attributed to the correct category.

4. Does the system alert you to any syncing errors?

With complex software integration, errors can happen. But knowledge is power and you don’t want to leave your members in the dark, especially when it comes to financial matters.

An integration that alerts you to any problems, ideally in the coworking management software itself, will allow you to get ahead and stay in control of the situation.

5. Does the integration support sequential invoicing regardless of what system an invoice is created in?

This will support good record keeping, and sequential invoicing may even be a regulatory requirement in your country.

6. Will a fully replicated invoice be created in the accounting system or will it just be a transaction record?

Having a fully replicated invoice will provide a more granular view of your revenue, and can be helpful from a planning and budgeting perspective.

7. How is tax handled?

Nobody likes getting a call from the tax authority! Make sure you understand how tax is handled and tracked to avoid a headache come tax time.

8. What manual effort needs to be done to supplement the integration?

Integrations are designed to save you time and make your operations more efficient. Having a good understanding of what your integration does not do will allow you to manage your team’s workload accordingly.

If your systems don’t speak to each other in the right way, you could face errors that negate the operational efficiencies that led you to invest in software in the first place.

Consulting your accountant, bookkeeper and/or CFO is a good place to start to ensure you understand the requirements for your business. They’ll have a strong understanding of what’s most important and what this integration needs to do.

For a complete list of how Xero and Quickbooks integrate with Optix, have a look at the guides below:

How to choose the best account software for your coworking space

Finding the right accounting software can be time-consuming, but it’s always a good idea to do it right the first time. That way, you won’t have to worry about switching software down the road.

Here’s a step-by-step guide on to how to choose the best accounting software for your business:

- Figure out what the needs of your space are: what accounting tasks are you currently doing manually? List them out to see what areas software can benefit you the most

- Map out your current tech ecosystem: if you’re using other tools in your space already, you’ll want to make sure you consider how everything will work together before you add another platform into the mix

- Determine your budget: decide ahead of time how much you are willing and able to spend on accounting software monthly and annually

- Create a list of need-to-have features: use the feature list above as a guide to help you determine which features your software absolutely needs to have and which are okay to leave out for now

- Research which software fits your needs: once you have a list of features you need and your budget, begin taking a deep dive into the software on the market. Talk to other operators, read online reviews, and check out articles to see what people really like and dislike about each product

- Shortlist your top 2-3 and sign up for a free trial (or book a demo): evaluating too many products at once can feel overwhelming. Find 2 or 3 that you think could fit your needs and sign up for a free trial or book a demo with a member of their team

Once you’re in the evaluation phase of your software, it comes down to your overall feelings around the platform. Do you like the look and feel? Will it satisfy your business’s unique needs?

Get started with accounting software and Optix

Use the framework above to help you choose the right software for your space.

Once you get set up with accounting, integrate it with your coworking software to move one step closer towards a fully autonomous space.

Want to learn more about how Optix integrates with your accounting software? Check out these guides to integrating Optix with Xero and integrating Optix with Quickbooks Online.