TL;DR

- Australia’s coworking industry is worth AUD $537M in 2025 and growing fast, driven by hybrid work, landlord partnerships, premium CBD demand, and expansion into suburban and regional hubs.

- Sydney and Melbourne dominate as the most expensive markets, while Brisbane, Perth, Adelaide, and coastal towns offer more affordable options.

- Competition is fierce — around 25% of independent spaces close annually — but those with strong brands, amenities, and communities thrive.

- Looking ahead, the sector is projected to grow at up to 23.6% CAGR through 2030, making Australia one of the world’s priciest and most dynamic coworking markets.

Australia’s coworking and flexible workspace market is in the middle of a transformation. From premium Central Business District (CBD) towers in Sydney to community-driven hubs in coastal towns, flexible workspaces are becoming a core part of how Australians work, collaborate, and build businesses.

In 2025, the Australian coworking industry is worth AUD $537 million and growing fast. New entrants are joining the market, landlords are partnering with operators to offer “space-as-a-service,” and regional areas are embracing coworking as a way to attract talent.

At the same time, competition is fierce — around a quarter of independent spaces may close in a given year — making it a market that rewards innovation, professionalism, and community-building.

In this article, we’ll explore key benchmarks and pricing trends shaping coworking in Australia today. Whether you’re an operator, landlord, investor, or simply curious about where the industry is headed, these insights will help you understand the state of coworking in Australia in 2025.

- How big is the coworking market in Australia?

- How much is the Australian coworking market worth in 2025?

- What’s driving coworking growth in Australia?

- Largest coworking cities in Australia

- Average coworking desk prices in Australia (by city)

- Most affordable coworking options in Australia

- Global comparison: how does Australia’s coworking market stack up?

- Future outlook for the Australian coworking market

- Running your Australian coworking space with Optix

How big is the coworking market in Australia?

Australia’s coworking industry may be smaller in absolute terms than the US or UK, but it’s significant relative to population — and it’s expanding again after a pandemic-era slowdown. As of 2023–2024, there were an estimated 211–223 coworking businesses (operators) nationwide.

The industry’s trajectory hasn’t been without challenges however. Following years of steady growth, Australia saw a slight contraction in operators after 2019 due to COVID-19-related closures and consolidation. Modest net growth returned in 2022–2023 with a 1.4% increase in operator numbers (IBISWorld).

While growth is now strong, churn remains a defining feature of the market. Industry observers note that around 25% of independent coworking spaces may close in a given year due to competition or sustainability issues. The spaces that thrive tend to be those offering high-quality amenities, a strong brand, and an engaged community — signalling that Australia’s coworking market is evolving toward more professionalised, resilient operators.

Running a coworking space in Australia? Let's talk.

How much is the Australian coworking market worth in 2025?

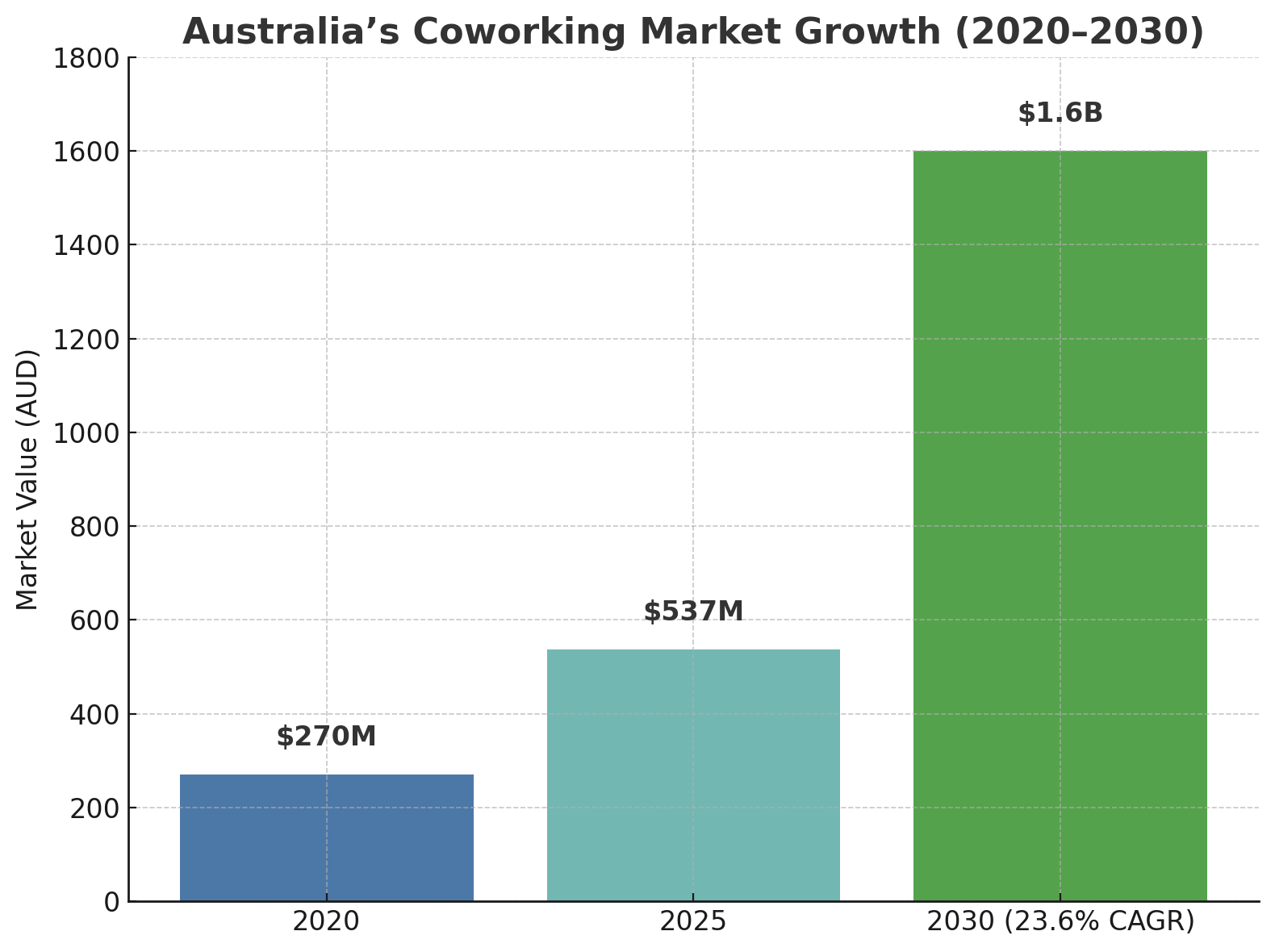

In 2025, Australia’s coworking and flexible workspace industry is valued at AUD $537 million. That’s nearly double its 2020 market size of AUD $270 million, underscoring just how far the sector has rebounded since the pandemic slowdown.

Next Move Strategy Consulting projects the Australian coworking market will grow at a compound annual growth rate (CAGR) of 23.6% from now until 2030. A more tempered forecast from Research and Markets still anticipates the market will double between 2025 and 2030, growing at a CAGR of ~15.1%.

These projections point to a sustained upward trajectory. Given Australia’s relatively high commercial property costs, operators who can secure strategic locations and flexible lease arrangements will be best positioned to capitalise on this demand.

What’s driving coworking growth in Australia?

Australia’s coworking market is expanding on the back of shifting workplace expectations, evolving landlord strategies, and the country’s unique blend of high-demand CBDs and fast-growing regional hubs. Here are the key drivers behind the sector’s growth:

1. Hybrid work as the new normal

The pandemic permanently altered workplace culture in Australia. All businesses, from startups to large corporations, now adopt hybrid work schedules, splitting their time between the office and their home. This has pushed companies to swap long-term, fixed leases for flexible coworking memberships that match fluctuating headcounts.

Get your free Marketing Strategy Template

2. Landlord partnerships and “space-as-a-service”

In premium office towers, especially in Sydney’s CBD and Collins Street in Melbourne, landlords are partnering with coworking operators to offer flexible floors within their buildings. This model, sometimes known as “space-as-a-service” benefits both parties: operators gain prime locations without taking on full lease risk, and landlords attract tenants seeking flexibility.

3. Premiumisation of CBD coworking

With limited CBD supply and high demand for quality, many operators are positioning themselves at the top end of the market, offering premium amenities, hospitality-driven services, and design-forward interiors.

In cities like Sydney and Melbourne, full-service coworking spaces often include:

- High-end coffee setups

- Event venues

- Wellness facilities

These extras are then reflected in the pricing.

4. Suburban and secondary market expansion

Rising CBD prices and the hybrid work shift have driven growth in suburban hubs such as North Sydney, Parramatta, and Richmond, as well as regional hotspots like the Sunshine Coast and Gold Coast. These markets appeal to workers who want professional space closer to home, often at a lower cost.

5. Community and brand resilience

While competition is intense (an estimated 25% of independent Australian spaces close each year), those that thrive are the ones offering strong community engagement, niche positioning, and consistent quality. For many members, coworking is as much about belonging to a collaborative, like-minded group as it is about having a desk.

Largest coworking cities in Australia

Sydney and Melbourne are Australia’s primary coworking hubs, with dense CBD footprints and premium offerings that rival the most expensive markets in the world.

Other major cities including Brisbane, Perth, Adelaide, and Canberra have growing coworking communities, typically with more moderate pricing. Beyond the capitals, regional and coastal hubs like the Sunshine Coast and Gold Coast are attracting remote workers and entrepreneurs seeking community outside of the big metro centres.

1. Sydney: the nation’s flex epicenter

Sydney remains Australia’s largest flexible office market and a top APAC player, supported by strong demand for high-quality CBD space (particularly premium towers in the Core/Barangaroo precincts). Recent figures show new CBD supply and a continued “flight to quality,” reinforcing Sydney’s lead.

2. Melbourne: scale with a value edge

Melbourne is Australia’s second-largest coworking market. While total CBD vacancy has been elevated, demand is increasingly focused on Premium/A-Grade space and on strong fringe precincts like Richmond and the Inner East, where occupancy has been more resilient.

3. Brisbane: steady growth and diversified demand

Brisbane’s CBD and “fringe” markets have seen growing interest as firms look for quality space closer to talent and transport, with flex operators benefiting from the broader office market’s stabilisation and flight-to-quality trend.

4. Perth and Adelaide: high return-to-office, solid utilization

Perth and Adelaide consistently post some of the strongest CBD attendance relative to pre-COVID levels, which supports coworking utilisation and makes these cities attractive for operators seeking stable demand profiles.

5. Canberra: government-adjacent flexibility

Canberra’s flex market is smaller but strategically important, serving federal contractors and hybrid public-sector teams that value short, flexible commitments near government precincts. (Trend consistent with national “flight to quality” dynamics and improved CBD attendance.)

Average coworking desk prices in Australia (by city)

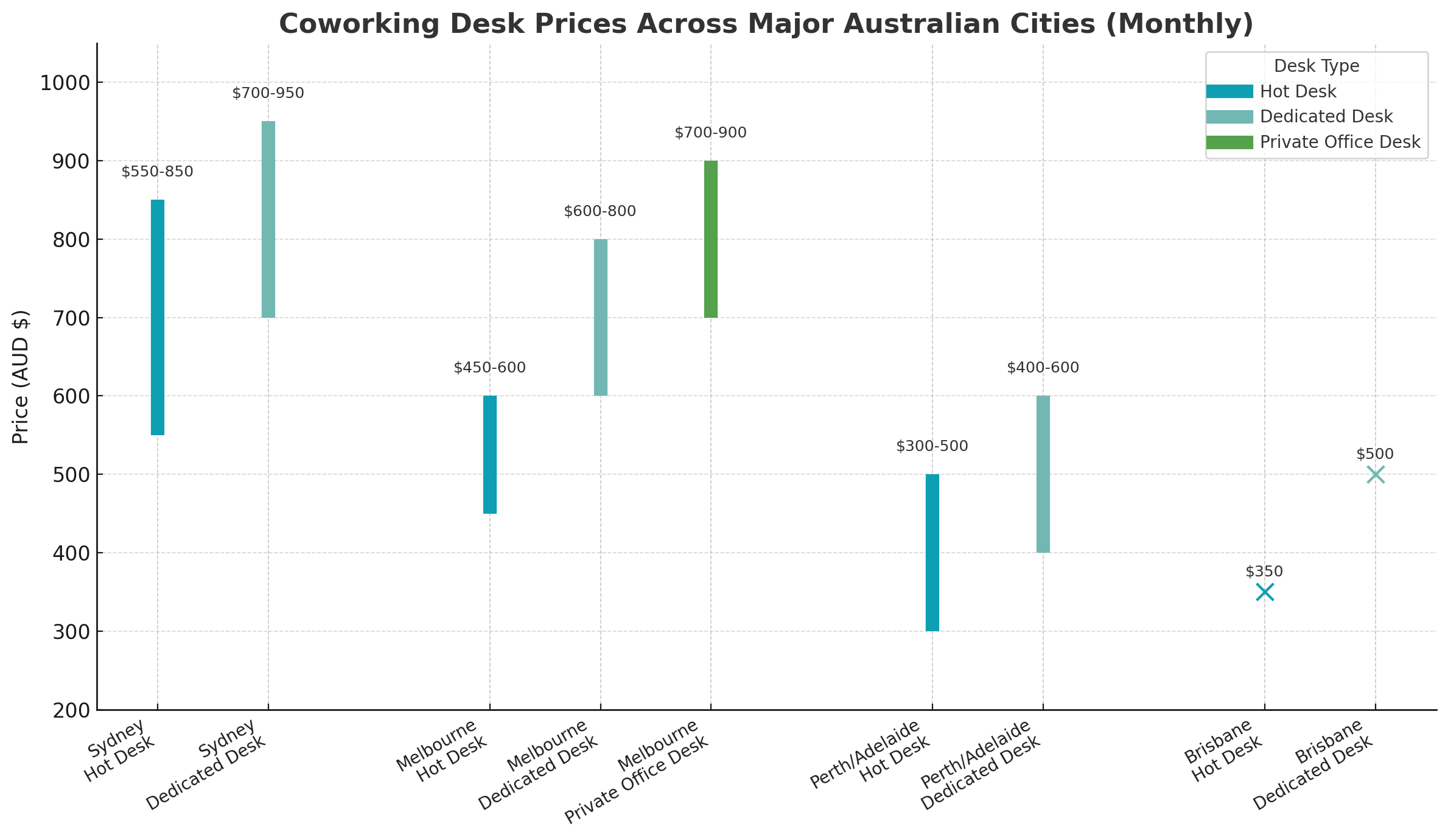

Coworking in Australia comes at a premium compared to many global markets, particularly in Sydney and Melbourne, which consistently rank among the top 10 most expensive countries for flexible workspace. The national average desk price sits at around USD $282 (~AUD $400) per month, but in prime CBD locations, rates can be double or more.

Sydney: Australia’s most expensive coworking market

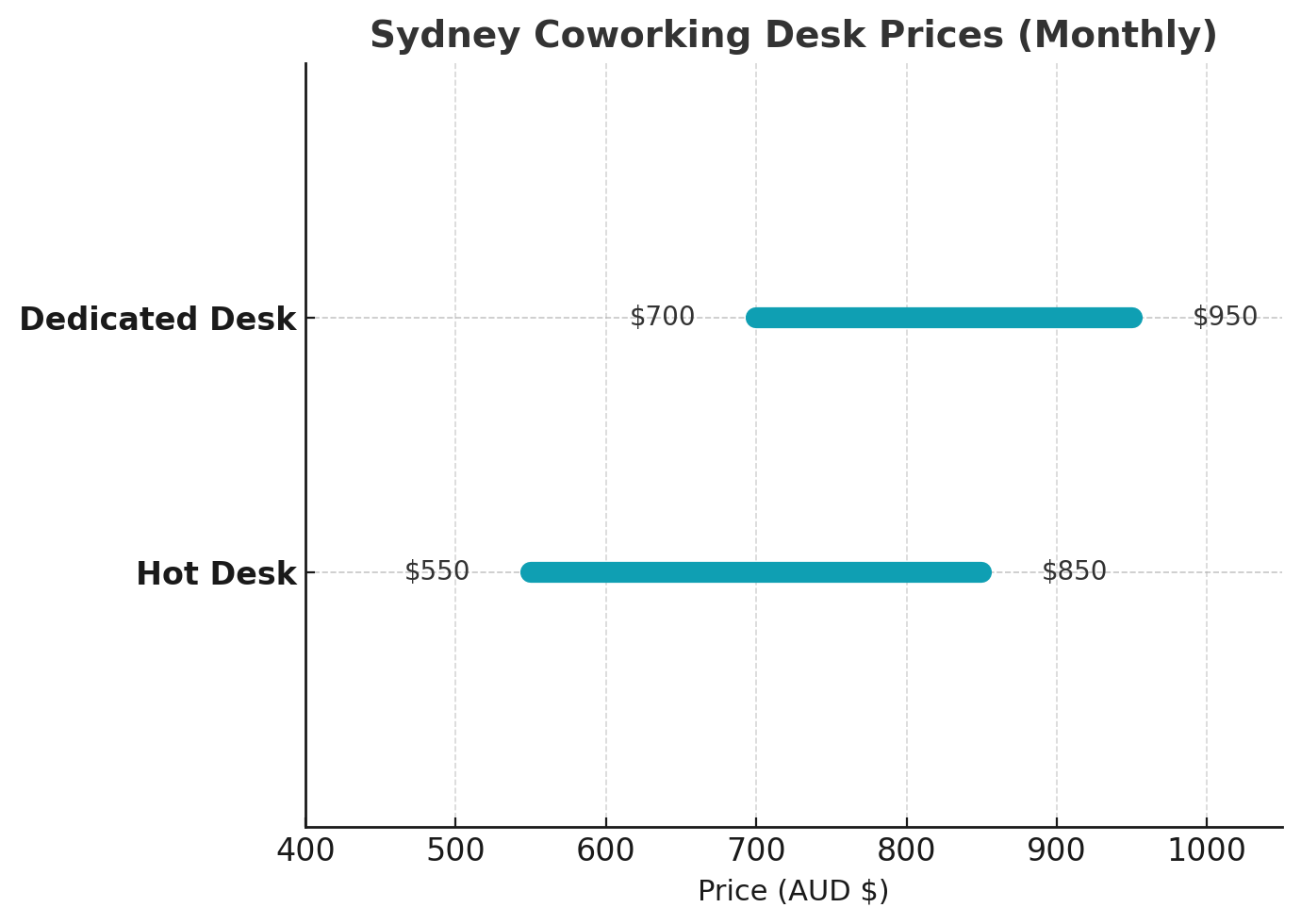

Hot desks in Sydney average $550–$850/month, with dedicated desks in premium CBD towers typically $700–$950/month. For example, a hot desk at WeWork in Sydney can cost $550/month, with a dedicated desk averaging $797/month.

It’s important to note that outside the CBD, prices drop sharply. Coworking spaces in North Sydney, Parramatta, or suburban coworking cafes can start around $200–$300/month.

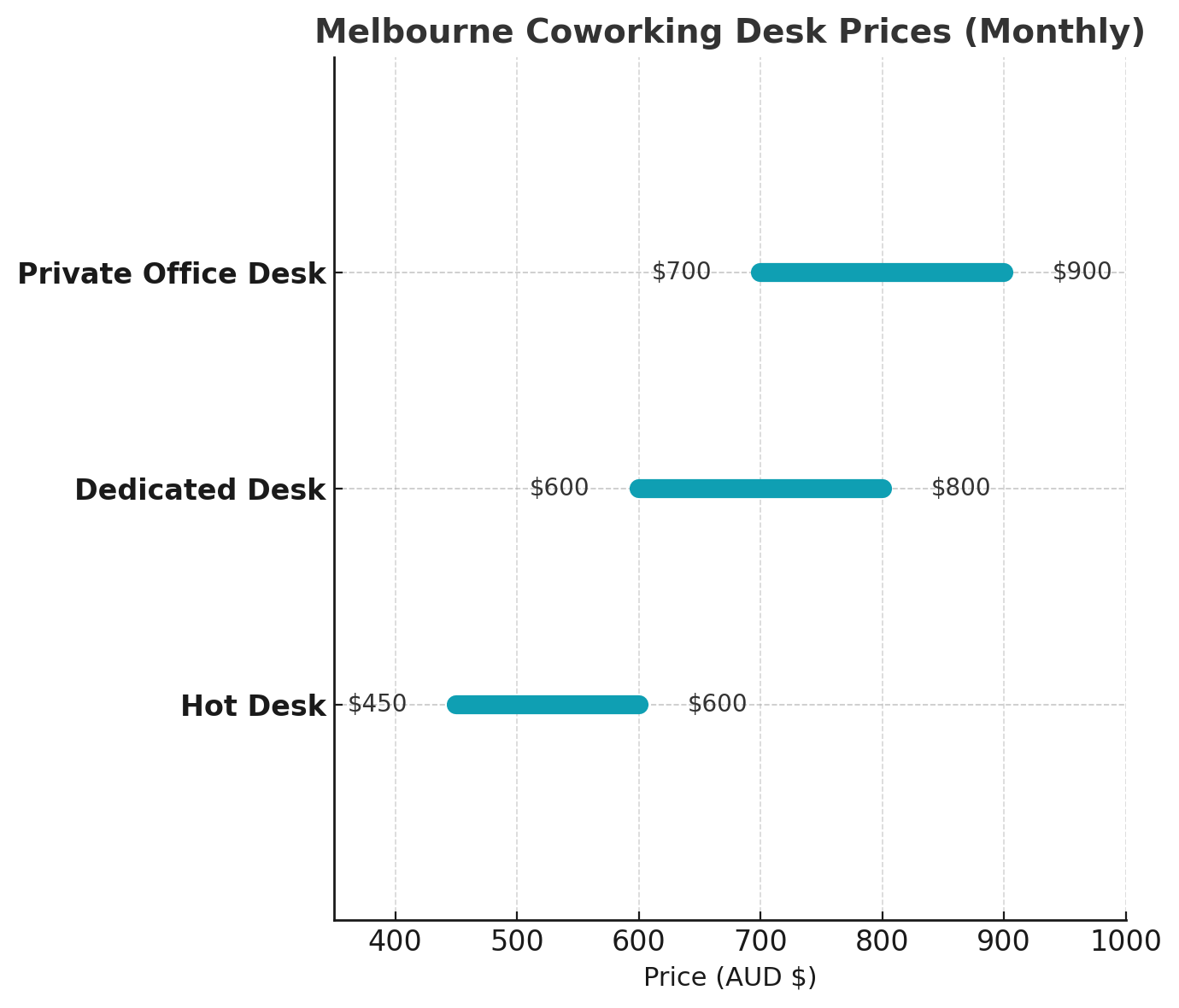

Melbourne: premium but slightly more affordable

Hot desks in Melbourne cost slightly less than Sydney with desks typically costing around $450–$600/month and dedicated desks $600–$800/month. Private office desks which are popular in the area can cost $700–$900/month per person.

On average, Melbourne is 10–15% cheaper than Sydney. Statista data from Q2 2023 put Sydney’s average desk at $980 vs Melbourne’s $780.

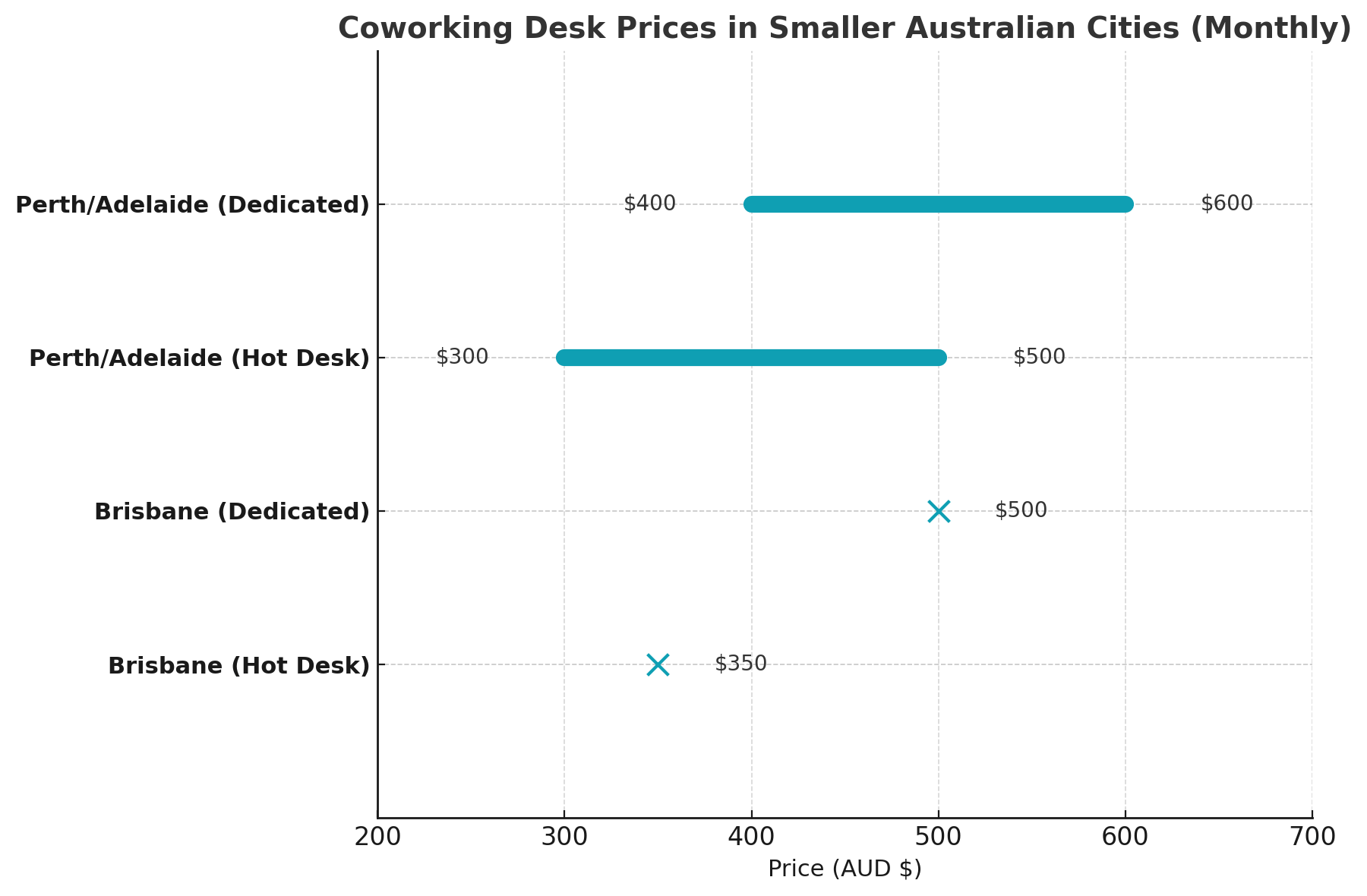

Brisbane, Perth, Adelaide: more moderate rates

In smaller cities like Brisbane, hot desks can cost around $350/month and dedicated desks upwards of $500/month in prime areas. Perth & Adelaide are close with hot desks in the range of $300–$500/month and dedicated desks around $400–$600/month.

In these smaller markets, local operators dominate, keeping rates competitive relative to Sydney and Melbourne.

Regional towns and coastal hubs: ultra-affordable

Many regional coworking spaces are backed by local councils or innovation programs. This allows them to offer desks at ultra-affordable prices, as low as $200/month, in hopes of stimulating local entrepreneurship and attracting remote workers. Examples can be found in Sunshine Coast, Gold Coast, and smaller inland towns.

What causes price discrepancy within a market?

Pricing is shaped by location, operator brand, and inclusions. Premium CBD spaces often bundle in hospitality services, high-end coffee, wellness facilities, and event programming. Outside core CBDs, operators compete more on flexibility and community — and less on luxury fitouts — which brings rates down.

Most affordable coworking options in Australia

While Australia’s prime CBD coworking spaces can command some of the highest rates in the world, there are still plenty of ways to secure a desk without breaking the bank. The most affordable options are typically found outside the CBD core, where lower overheads translate to lower monthly rates.

Suburban coworking hubs

Many suburban hubs — such as North Sydney, Parramatta, and Chatswood — offer hot desks starting at A$200–$300/month. Here, members still get professional facilities, community networking, and meeting room access, but without paying CBD premiums. These spaces often appeal to hybrid workers who want a local base a few days per week.

Regional and coastal coworking spaces

In towns like Sunshine Coast, Gold Coast, Byron Bay, and Ballarat, council-backed coworking initiatives and innovation hubs sometimes charge under $200/month for a hot desk. These spaces typically prioritise fostering local entrepreneurship and remote work communities over luxury amenities.

Global comparison: how does Australia’s coworking market stack up?

Australia’s coworking market sits firmly at the premium end of global pricing, particularly in Sydney and Melbourne, where high commercial real estate costs and demand for quality amenities keep rates elevated.

Australia among the most expensive markets globally

Servcorp’s 2024 global comparison ranked Australia as the 10th most expensive country for coworking, with an average monthly desk cost of USD $282 (~AUD $400). In Sydney CBD, average hot desk prices of A$550–$850/month and dedicated desks up to A$950/month place it alongside — or above — pricing in New York, London, and Singapore.

Competitive positioning in the Asia-Pacific

Compared to other APAC markets, Sydney and Melbourne outprice coworking hubs like Hong Kong and Tokyo in many premium locations, but fall just below Singapore’s ultra-prime rates.

In emerging APAC coworking markets — such as Vietnam, Indonesia, and the Philippines — desk prices can be less than a quarter of Sydney’s averages, highlighting the gap between developed and developing economies in the region.

Why Australia commands high prices

Several factors drive Australia’s high desk rates:

- Limited CBD supply relative to demand in major cities

- Premiumisation of offerings, with full-service amenities included

- Strong corporate and enterprise adoption of flexible space

- Landlord-operator partnerships bringing coworking into top-tier office towers

Overall, Australia’s coworking market competes at the upper tier globally for price and quality, making it an attractive — if costly — location for operators and members seeking world-class workspaces.

Future outlook for the Australian coworking market

The Australian coworking and flexible workspace industry is poised for sustained growth through the rest of the decade, driven by shifting workplace models, evolving landlord-operator relationships, and the continued professionalisation of the sector.

Strong growth potential

IBISWorld projects the market to continue expanding beyond its $537 million 2025 value, buoyed by demand from corporates, SMEs, and remote workers. High-growth forecasts, such as NextMSC’s 23.6% CAGR from 2024–2030, suggest the potential for rapid scaling, especially if suburban and regional hubs reach critical mass.

Expansion into new geographies

Expect to see continued decentralisation of coworking supply. Areas like Parramatta, North Sydney, and Richmond are attracting both independent operators and established brands. Sunshine Coast, Gold Coast, and other lifestyle destinations are becoming coworking magnets for remote professionals.

Professionalisation and consolidation

High churn rates (~25% of independents closing annually) will likely persist, but the operators that survive will be larger, better-capitalised, and brand-strong. Partnerships with landlords — particularly in premium CBD towers — are expected to become a standard growth model, reducing operators’ risk while allowing landlords to monetise underused floors.

Rising competition and member expectations

Australia’s premiumisation trend means spaces must differentiate through design, hospitality, tech integration, and community. Members will expect more than just a desk — from curated events and wellness offerings to high-spec meeting facilities and sustainability commitments.

Risks to watch

- Economic headwinds: Rising interest rates and inflation could impact small business memberships.

- Supply-demand balance: Rapid expansion could saturate certain markets, putting pressure on occupancy rates.

- Global competition: Digital-first companies may opt for offshore coworking memberships in lower-cost APAC markets if quality is comparable.

Running your Australian coworking space with Optix

Optix is helping Australian coworking spaces unlock new levels of efficiency and growth through automation. By automating mundane, day-to-day tasks, spaces can focus on what matters most: building strong communities and delivering exceptional member experiences.

KoWorks, for example, leverages Optix to successfully run three thriving locations in Sydney with just a single employee, proving how powerful automation can be in scaling a business without additional overhead.

Meanwhile, Hello Friend has used Optix to achieve 100% occupancy, turning technology into a growth engine that keeps their space full and their community engaged.

Whether it’s saving time, reducing costs, or driving occupancy, Optix empowers coworking operators across Australia to run smarter, leaner, and more profitable businesses. Get in touch with a member of our team to learn how Optix can help your business succeed.

Optix is the coworking software you've been waiting for.

Frequently asked questions

Australia’s coworking and flexible workspace industry is valued at AUD $537 million in 2025, nearly double its 2020 size. With forecasts of 15–23.6% CAGR through 2030, the sector is set for sustained growth, making it one of the world’s most dynamic coworking markets.

Key drivers include the shift to hybrid work, landlord partnerships offering “space-as-a-service”, the premiumisation of CBD spaces, and the expansion into suburban and regional hubs such as Parramatta, Richmond, and the Sunshine Coast.

Sydney and Melbourne dominate the coworking landscape with premium CBD offerings. Brisbane, Perth, Adelaide, and Canberra are also seeing steady growth, while regional and coastal hubs like the Gold Coast and Sunshine Coast are attracting remote workers and entrepreneurs.

Australia ranks among the top 10 most expensive coworking markets globally due to limited CBD supply, premium full-service amenities, strong corporate adoption, and landlord-operator partnerships in prime office towers. Desk prices in Sydney rival those in New York, London, and Singapore.

Roughly 25% of independent coworking spaces close annually due to intense competition. Operators must differentiate with community engagement, brand strength, hospitality-driven services, and innovative amenities to survive and thrive.

The future is strong, with continued growth in suburban and regional hubs, greater professionalisation and consolidation among operators, and rising member expectations around design, tech integration, and community. Economic headwinds and oversupply risks remain, but overall momentum is positive.