TL;DR

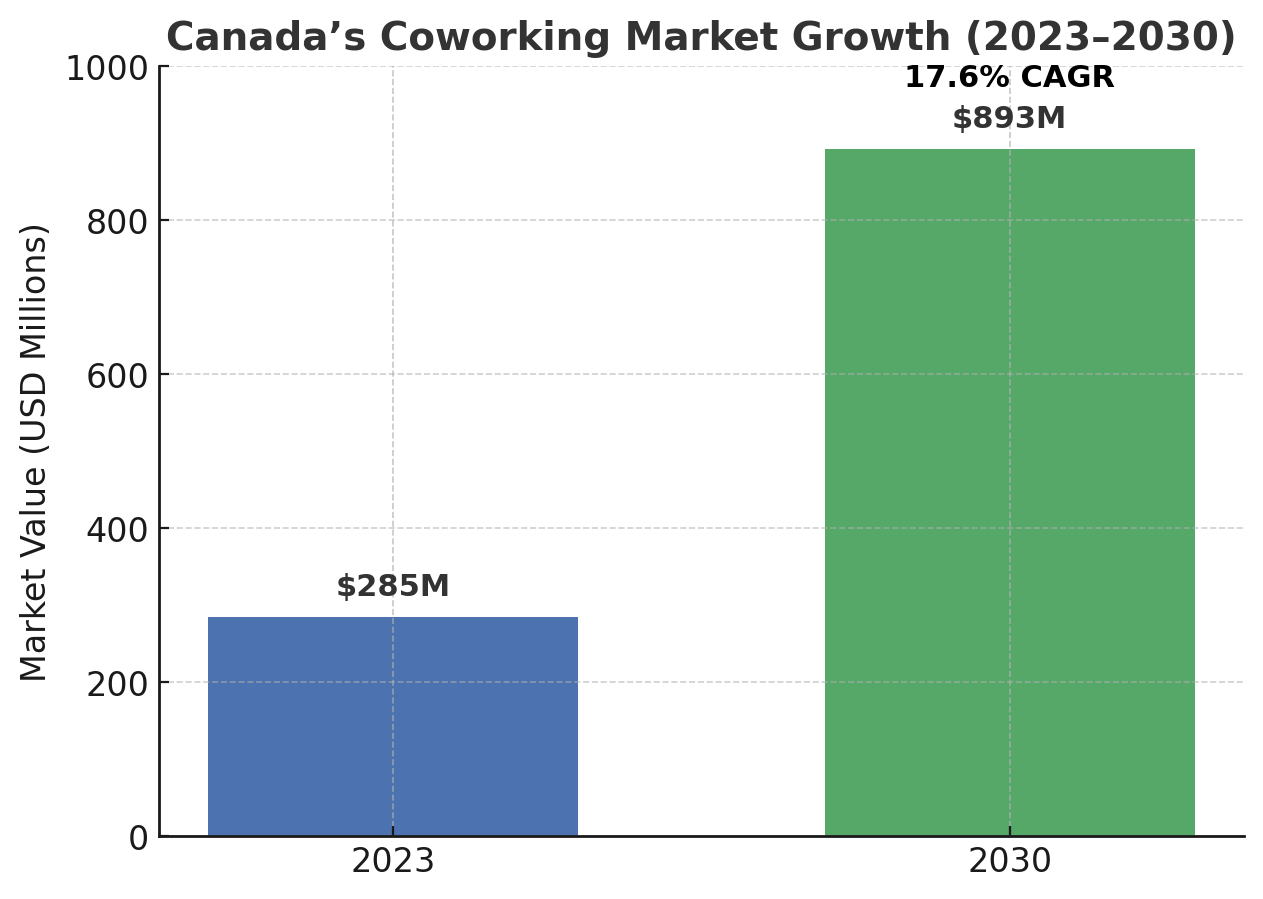

- Canada’s coworking market is projected to nearly triple from $285 million in 2023 to $893 million by 2030, driven by hybrid work adoption and expansion beyond major cities.

- Toronto and Vancouver command the highest rates while Montreal offers more affordable options, with hot desks averaging $200-400 CAD monthly and private offices ranging from $400-1,200+ CAD.

- Success for operators lies in local-first positioning, flexible membership options, and leveraging emerging opportunities in suburban markets and secondary cities like Calgary, Ottawa, and Waterloo.

Over the past decade, coworking has transformed from a niche solution for freelancers into a mainstream workplace strategy embraced by startups, SMEs, and some of Canada’s largest corporations.

What began as a handful of shared offices in major urban centres has evolved into a thriving ecosystem of ~883 coworking spaces nationwide as of May 2025, with the largest concentrations in Ontario, Quebec, and British Columbia, and an accelerating spillover into mid-sized cities and suburban hubs.

In this report, we’ll dive deep into market benchmarks, pricing data, regional trends, and growth drivers shaping Canada’s coworking industry in 2025 — and explore where the biggest opportunities lie for operators in the years ahead.

- How big is the coworking market in Canada?

- How does coworking differ across different Canadian regions?

- Benchmark pricing for coworking spaces in Canada

- The coworking landscape in Canada

- What does the future of the Canadian coworking space landscape look like?

- What should Canadian coworking operators do to grow their coworking business?

- The Canadian coworking market is expanding

How big is the coworking market in Canada?

Canada’s coworking industry may be smaller than its U.S. counterpart, but it’s growing at a pace that outstrips many global markets. In 2023, the sector was valued at USD $285 million, with projections estimating it will nearly triple to USD $893 million by 2030, a remarkable 17.6% compound annual growth rate.

With flexible and shared offices now representing roughly 8% of the nation’s total office inventory, coworking has firmly established itself as part of the country’s commercial real estate fabric.

This expansion is being fueled by several converging trends:

- Hybrid and remote work adoption: more companies are replacing traditional long-term leases with flexible workspace agreements

- Expansion beyond big cities: operators are opening new locations in mid-sized and suburban markets such as Ottawa, Waterloo, and Kelowna

- Post-pandemic demand rebound: workers are returning to shared spaces for collaboration, community, and access to professional amenities

How does coworking differ across different Canadian regions?

Canada’s coworking footprint is concentrated in a handful of major urban centres, but its reach is steadily expanding into smaller cities and suburban communities. This geographic diversification is reshaping how and where Canadians experience flexible work.

Running a coworking space in Canada? Let's talk.

The coworking market in Toronto, Vancouver, and Montreal

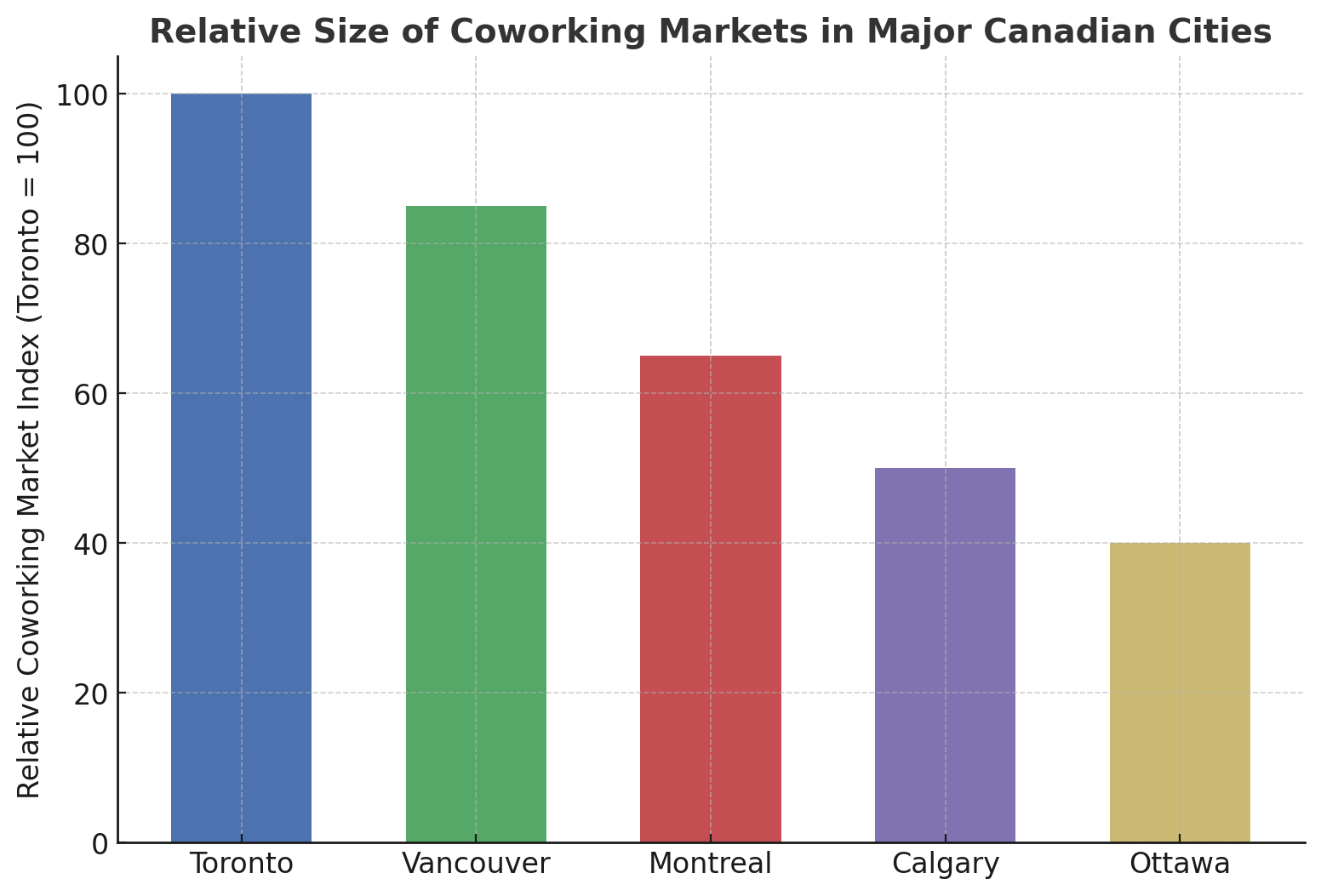

- Toronto (Ontario) remains Canada’s largest coworking market, driven by its role as the country’s financial and tech hub. The city boasts dozens of coworking hubs, from premium spaces in the Financial District to community-focused venues in emerging neighbourhoods.

- Vancouver (British Columbia) rivals Toronto in density, reflecting both its high cost of living and strong startup culture. Downtown Vancouver and Coal Harbour command some of the country’s highest coworking rates, while suburban options in Burnaby, Surrey, and Richmond offer more accessible price points.

- Montreal (Quebec) stands out as a more affordable alternative, with a thriving bilingual market that appeals to both local entrepreneurs and international businesses entering Canada.

Growth of coworking in secondary Canadian cities

While the majority of coworking activity is still in the big three metros, mid-sized cities and rural coworking communities are showing strong growth potential:

- Calgary is emerging as a coworking hotspot for its entrepreneurial energy and efforts to diversify beyond oil and gas.

- Ottawa benefits from a mix of public sector workers, tech professionals, and freelancers seeking hybrid-friendly space.

- Edmonton, Winnipeg, and Halifax are seeing steady openings, often in repurposed buildings or as part of mixed-use developments.

Waterloo has one of the highest coworking penetration rates relative to its office market, nearing 1.8% of total office supply.

The suburban opportunity for Canadian coworking spaces

The rise of hybrid work is encouraging operators to set up shop closer to where people live.

Brands like IWG (Regus) have announced multi-location suburban expansion plans, including 13 new locations adding 168,000 sq ft of space across Canada. This aligns with industry predictions that suburban coworking will be one of the fastest-growing segments over the next five years.

Benchmark pricing for coworking spaces in Canada

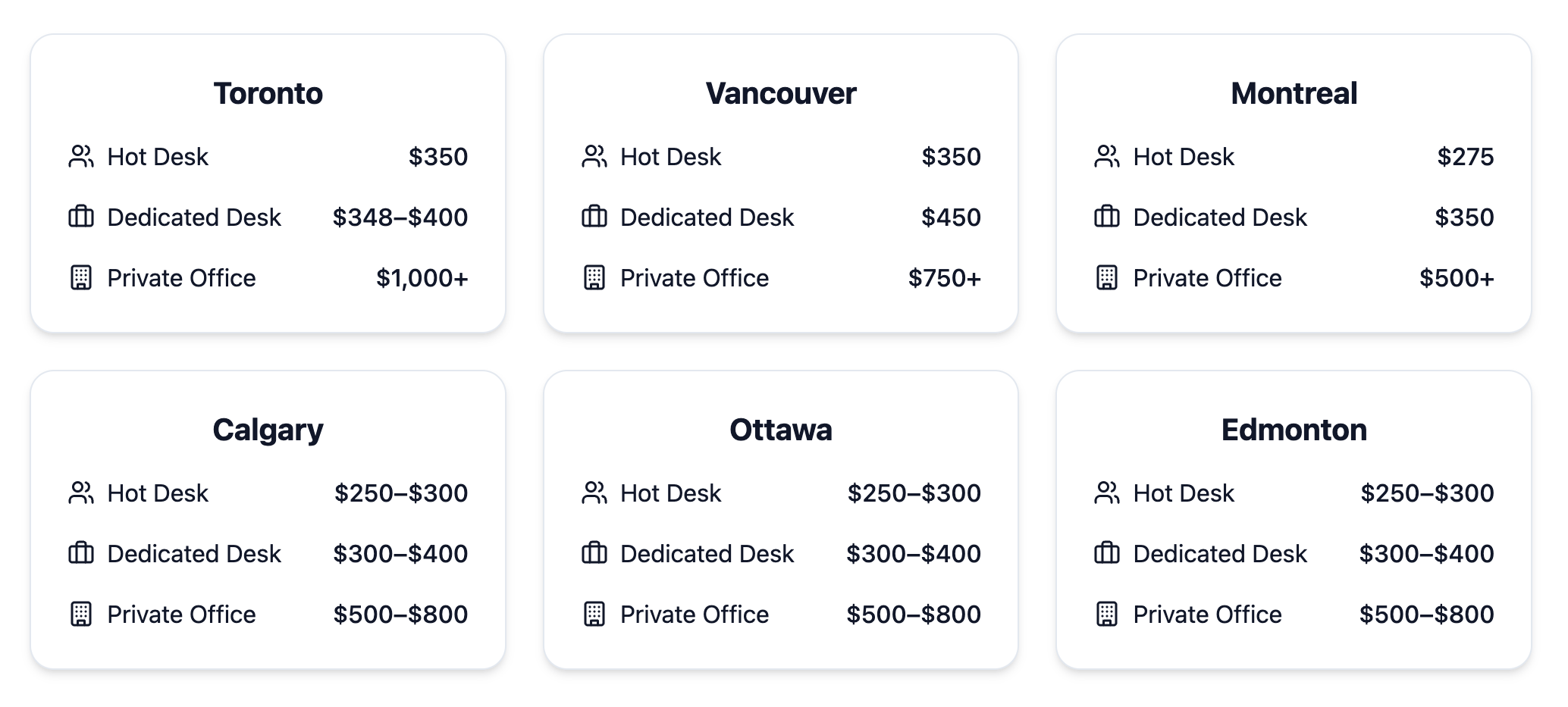

Canadian coworking pricing is competitive on a global scale and generally lower than equivalent big-city U.S. rates when converted to USD. Rates vary widely by city, operator, and location within a city, with Toronto, Vancouver, and Montreal leading the pricing spectrum.

Average monthly rates by city (CAD)

Key pricing insights

- Canadian rates are 20–30% lower than in U.S. major cities when converted into USD (ie. CAD $350 ≈ USD $260 for a hot desk).

- Toronto and Vancouver command the highest rates, particularly for premium downtown private offices.

- Montreal offers some of the most affordable big-city coworking in North America, with rates significantly below Toronto/Vancouver averages.

- Secondary cities like Calgary, Ottawa, and Edmonton price slightly below major markets, but limited supply can push rates higher for well-located spaces.

- Private offices see the widest price range, driven by location, amenities, and building class — from budget-friendly suburban units to premium downtown suites exceeding CAD $1,000 per person.

What’s included in an average coworking space membership in Canada?

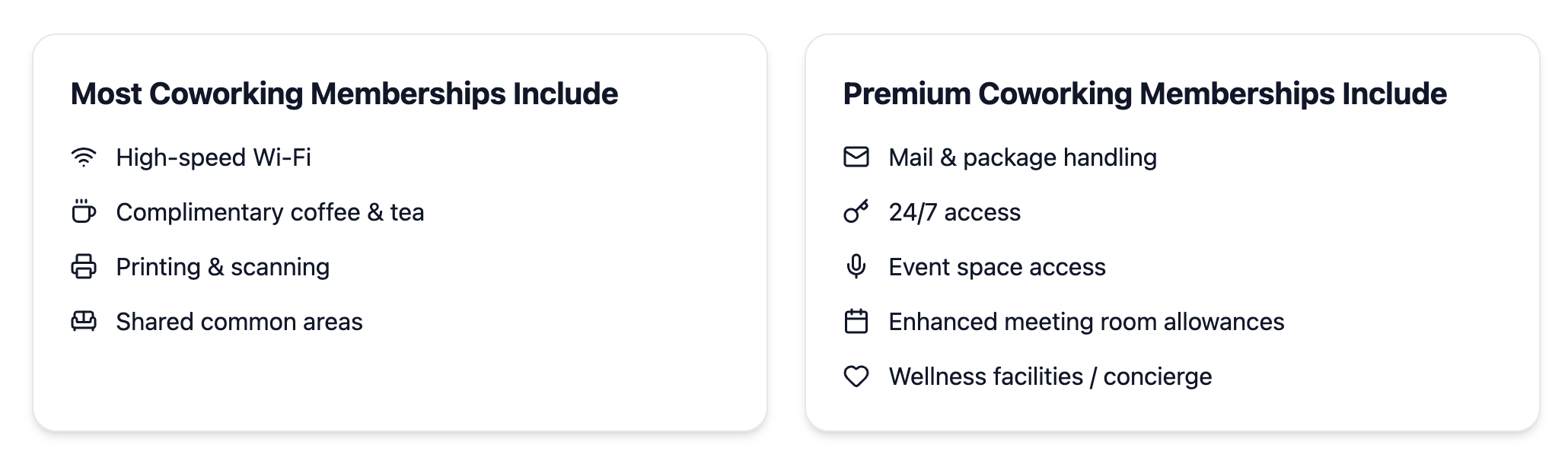

Most coworking memberships in Canada include:

- High-speed Wi-Fi

- Complimentary basic coffee and tea

- Printing and scanning

- Access to shared common areas

Premium memberships often add:

- Mail/package handling

- 24/7 access

- Event space access

- Enhanced meeting room allowances

- Wellness facilities or concierge services

Part-time options (ie. 10-day/month hot desk passes) are increasingly common, catering to hybrid professionals who only work from a coworking space part of the week.

The coworking landscape in Canada

Canada’s coworking landscape is a mix of global giants, established national brands, and a vibrant network of independent operators. This diversity creates a competitive but highly fragmented market, one where location, community, and specialization often matter as much as brand recognition.

Major players in the Canadian coworking market

- The largest flexible workspace operator in Canada by location count

- As of late 2023, announced 13 new suburban and urban locations totaling 168,000 sq ft

- Focuses on a mix of premium downtown spaces (Spaces) and more traditional serviced offices (Regus), with a growing suburban push

- Despite global challenges, WeWork still maintains a presence in 12 Canadian buildings, including flagship spaces in Toronto and Vancouver

- Offers pay-as-you-go access through WeWork On Demand, appealing to hybrid and traveling workers

Other notable multi-location brands

- Staples Studio: expanding in Ontario with coworking integrated into retail locations

- The Professional Centre (TPC): Focused on premium downtown Toronto clientele.

Independent and community-led operators

Independent spaces make up a significant share of Canada’s coworking ecosystem, often thriving by tailoring services to local markets and building strong community engagement.

Suite Genius (Vancouver)

Suite Genius is a coworking network with three locations in and around Vancouver, British Columbia, known for their beautiful spaces and commitment to community over their ten-plus years in the local coworking scene.

KWENCH (Victoria)

KWENCH is a hospitality-driven work and social club in Victoria, BC, focused on supporting balanced, happy humans to lead engaged and inspired lives, with over 450 members who are considered the lifeblood of their operation.

OneSpace (Vancouver)

OneSpace is a unique coworking space founded in 2021 by co-founders Elizabeth and Victoria to address the isolation of parenthood and entrepreneurship by creating a community-focused workspace where parents can be productive while having their children play nearby and accessing on-site childcare services.

These operators often differentiate through curated events, local partnerships, or niche positioning (ie., female-focused coworking, creative studios, or industry-specific hubs).

Fragmentation within the coworking space market in Canada

The Canadian coworking market is fragmented, with:

- Major chains controlling over half of total market share.

- Independents and small networks comprising about one-third of the sector (Business Research Insights).

- Remaining share split between niche operators and emerging hybrid models (e.g., coworking embedded within hotels or retail environments).

Fragmentation benefits members by providing choice and innovation but also presents challenges for operators competing against larger networks with broader marketing reach and resources.

Competition is expected to intensify as demand rises, particularly in suburban and secondary markets where brand loyalty is less entrenched. For independent operators, this means leaning into hyper-local differentiation — from community programming to unique design — while larger players will continue to leverage scale, brand recognition, and enterprise sales channels to capture market share.

What does the future of the Canadian coworking space landscape look like?

Canada’s coworking market is on a clear upward trajectory, with stronger growth forecasts than the global average and expansion opportunities that extend far beyond major metro areas.

Over the next five years, several structural shifts and emerging trends will shape the sector’s evolution, offering both opportunities and challenges for operators.

Growth drivers to watch for Canadian coworking spaces

| Hybrid work permanence | Even as some companies mandate partial office returns, the appetite for flexibility remains high. Hybrid schedules will keep driving demand for part-time memberships, day passes, and “hub-and-spoke” workspace models. |

| Suburban and secondary market boom | Operators are already opening in mid-sized cities like Waterloo, Kelowna, and Halifax, and suburban hubs near major metros. These locations capture professionals seeking shorter commutes and stronger community connections. |

| Corporate coworking adoption | Large enterprises are increasingly using coworking as an alternative to long-term leases, either for satellite teams or as part of a hybrid workplace strategy. This trend is likely to accelerate as companies prioritize flexibility and cost control. |

| Experience-led differentiation | As competition grows, operators will differentiate through design, curated events, and industry-specific offerings (e.g., creative studios, health & wellness coworking, women-led spaces). |

What should Canadian coworking operators do to grow their coworking business?

1. Local-first positioning

Independent spaces can thrive by embedding themselves in the local ecosystem — hosting community events, partnering with nearby businesses, and reflecting local culture in design and branding.

2. Flexible product mix

Offering part-time memberships, team bundles, and virtual mail services can capture hybrid workers and small business clients who need occasional physical presence.

3. Partnerships with landlords and developers

With office vacancies in some Canadian cities still high, there’s opportunity to partner with property owners to activate underutilized space.

4. Tech integration

Seamless booking, access control, and community engagement tools will be critical for delivering the flexibility members expect.

5. Sustainability as a selling point

Eco-conscious design, green certifications, and responsible sourcing can appeal to Canada’s environmentally aware workforce.

The Canadian coworking market is expanding

If growth projections hold, Canada’s coworking market will more than triple in value by 2030, with flexible space becoming a standard component of commercial real estate portfolios.

Operators that balance location strategy, service quality, and adaptability will be best positioned to capture a share of this expanding market — and to shape the future of work in Canada.

Optix is the coworking software you've been waiting for.

Frequently asked questions

Canada’s coworking industry was valued at USD $285 million in 2023 and is projected to nearly triple to $893 million by 2030. This represents a compound annual growth rate of 17.6 percent, placing Canada among the fastest-growing coworking markets globally.

By May 2025, Canada had approximately 883 coworking spaces in operation. The majority are concentrated in Ontario, Quebec, and British Columbia, with a growing number of new locations emerging in mid-sized cities such as Calgary, Ottawa, and Waterloo.

Toronto is Canada’s largest coworking hub, fueled by its financial and technology sectors, while Vancouver rivals it in density with some of the highest coworking rates in the country. Montreal offers a more affordable alternative with a thriving bilingual market. Secondary cities like Calgary, Ottawa, and Waterloo are rapidly gaining traction due to hybrid work trends and suburban demand.

The largest operator in Canada is IWG, which runs Regus and Spaces and continues to expand in suburban and urban areas. WeWork also maintains a presence in 12 Canadian buildings, particularly in Toronto and Vancouver, and offers flexible on-demand options.

The Canadian coworking sector in 2025 is shaped by hybrid work fueling demand for flexible memberships, suburban and secondary markets like Waterloo and Halifax gaining traction, growing corporate adoption of satellite offices, and operators differentiating through curated experiences, wellness amenities, and niche-focused spaces.