Marketing Manager

Since Optix’s founding 10 years ago, we’ve seen a lot of changes in the coworking and flex space industry.

We’ve watched coworking grow from a grassroots community-driven concept to a full-on global phenomenon. Now in 2025, it is one of the fastest growing segments of real estate around the world.

Here are 60+ stats and findings on the coworking industry in 2025 from top sources (DeskMag, CBRE, JLL, Cushman & Wakefield, CoworkingCafe, Wall Street Journal).

These statistics have been fact-checked and updated as of November 2025 to ensure accuracy and to comply with our editorial guidelines.

- Global coworking market size and growth

- Number of coworking spaces around the world

- Coworking space occupancy and utilization benchmarks

- Pricing (memberships and desk rates) benchmarks for coworking spaces

- Coworking industry trends in revenue and profitability

- Coworking amenities and use of space

- Real estate and coworking spaces

- Coworking and share of office space

- Coworking space member demographics

- Automation and technology use in coworking spaces

Global coworking market size and growth

1. The global coworking market was estimated at USD $14.91 billion in 2023 and is projected to reach USD $40.47 billion by 2030. (Grandview Research)

2. The global coworking market could reach up to USD $93.68 billion by 2035. (Market Research Future)

3. By 2030, JLL predicts that 30% of all office space will be flexible. (JLL)

4. From 2010–2019, the coworking market grew ~23% annually on average, outpacing traditional office growth. (Retail Dive)

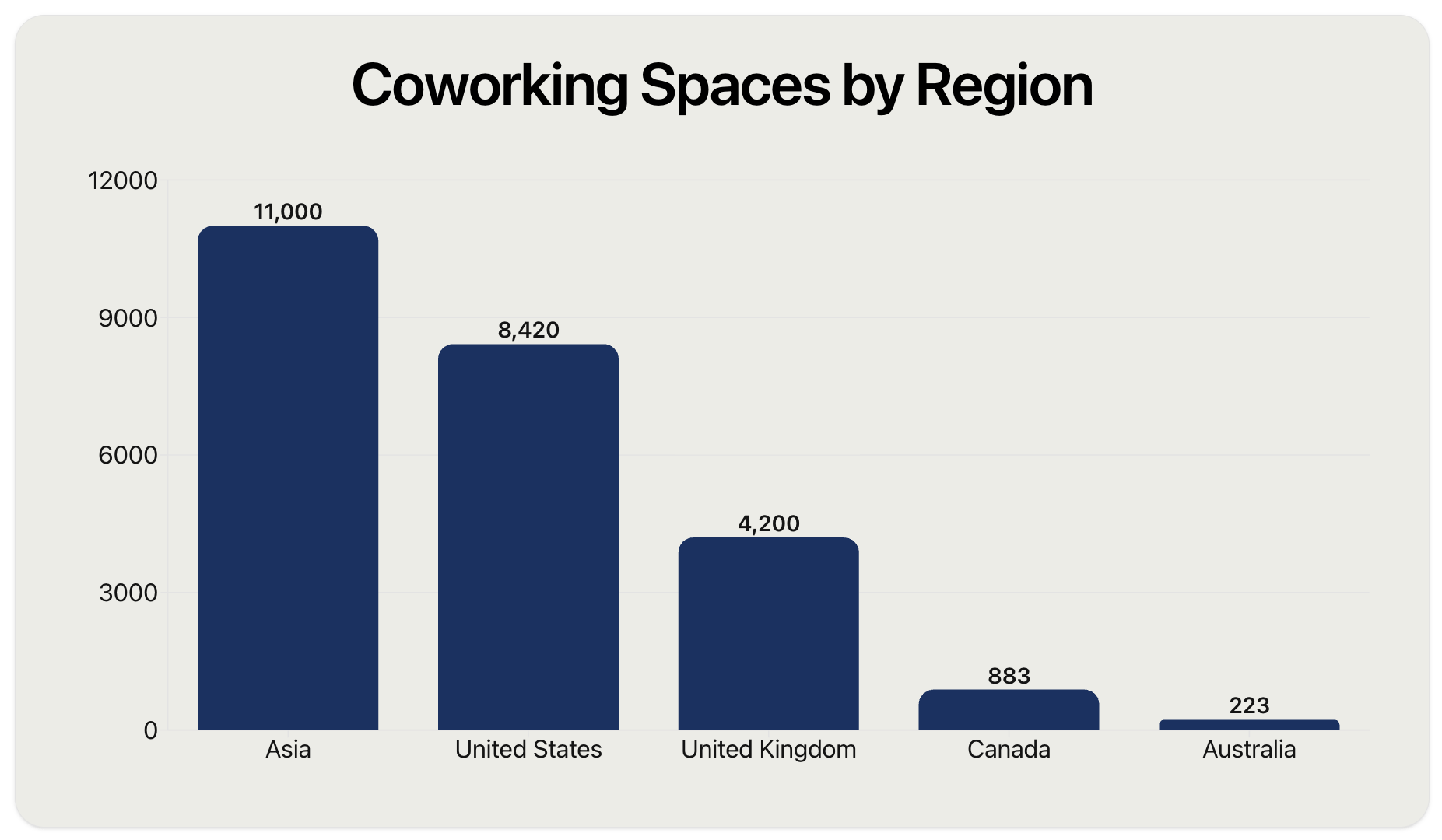

Number of coworking spaces around the world

5. United States: The U.S. is one of the largest coworking markets in the world with approximately 8,420 coworking spaces nationwide as of Q3 2025. (CoworkingCafe)

6. United Kingdom: There are just under 4,200 coworking spaces across the UK, including the British Isles, as of 2025. (CoworkingCafe)

7. Canada: There are around ~883 coworking spaces in Canada nationwide as of May 2025. (SmartScrapers)

8. Australia: As of 2024, there are an estimated 223 coworking spaces in Australia nationwide. (IBISWorld)

9. Asia: There are 11,000 coworking spaces in Asia as of 2022. (CorporateSuites)

10. India: The coworking market in India is booming, with nearly 2,200 coworking spaces as of 2023. (The Address)

11. Latin America: flexible space demand increased by 29% in 2023 across Latin America, with Mexico City seeing 163% growth year-over-year. (Allwork.space)

Coworking space occupancy and utilization benchmarks

12. The global occupancy rate for coworking spaces reached 68% at the start of 2025. (DeskMag)

13. Occupancy rates across major cities averaged above 70% occupancy, while smaller towns were lower (but rising). (DeskMag)

14. 50% of coworking spaces globally report high or very high demand for meeting space. (DeskMag)

15. Meeting room bookings surged in 2024 with bookings up on average 21.3% year-over-year. (Cushman & Wakefield)

16. In London, private office occupancy is 82%. (Allwork.space)

17. A “healthy” occupancy rate for coworking spaces is 80–85% according to industry benchmarks.

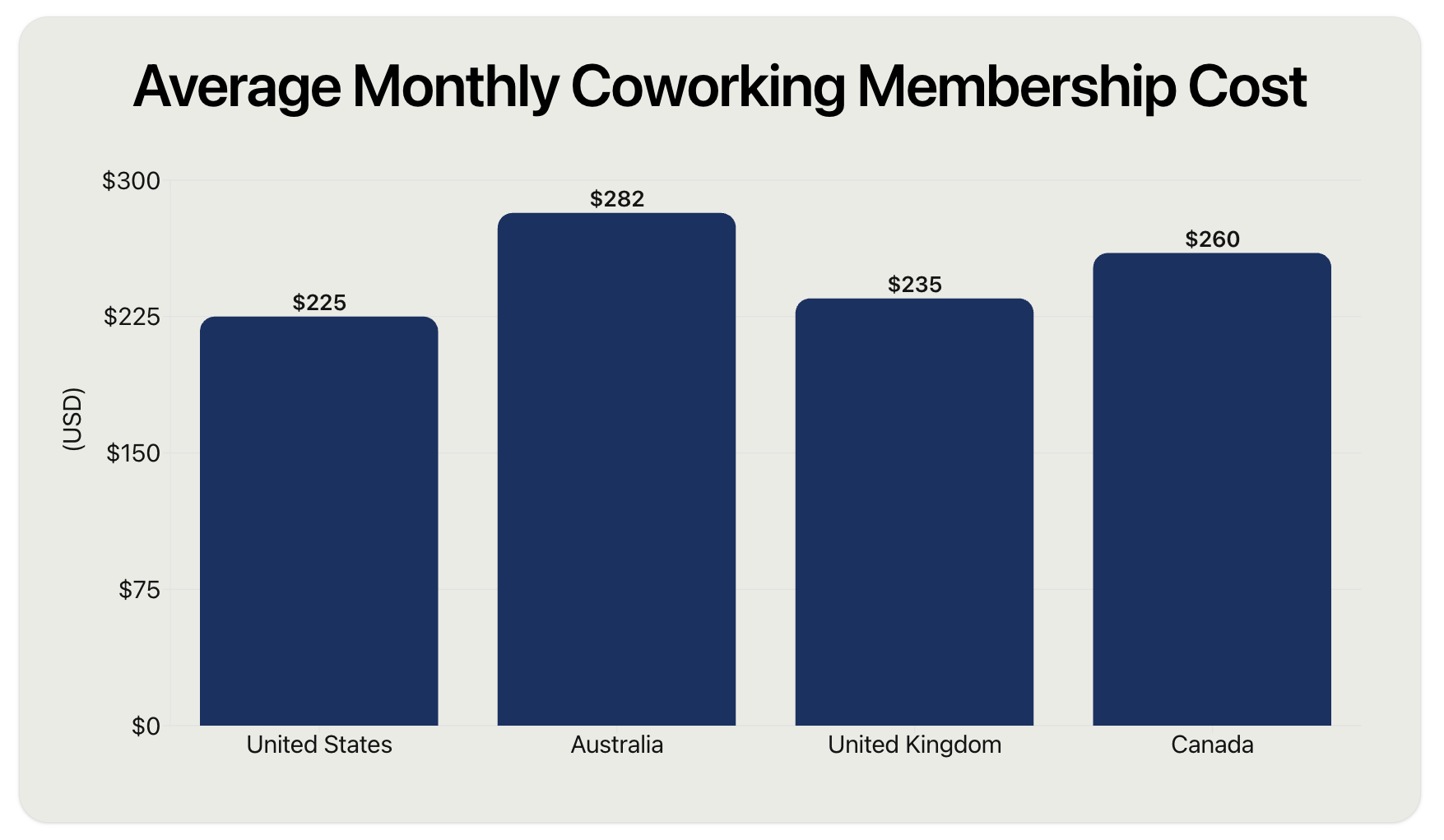

Pricing (memberships and desk rates) benchmarks for coworking spaces

18. United States: the average cost of a coworking membership plan is $159/mo for virtual offices and $225/mo for desk membership. (CoworkingCafe)

19. Australia: the average cost of a coworking membership plan is USD $282/mo. (Office Flex Finder)

20. United Kingdom: the average cost of a coworking membership plan is USD $235/mo. (PsychReg)

21. Canada: the average cost of a coworking membership plan is USD $260/mo. (Optix)

22. United States: the average cost of a daily coworking membership is $30/day for a hot desk and $45/hr for a meeting room. (CoworkingCafe)

Coworking industry trends in revenue and profitability

23. United States: coworking spaces earn about $4.20/ft² per month in the U.S, or roughly $50/ft² annually. (DeskMag)

24. Europe: coworking spaces earn about USD $3.21/ft² per month, with higher regional variance in Paris. (DeskMag)

25. The top revenue streams for coworking spaces (in order) are: private offices, monthly desk membership plans, and meeting room rentals. (DeskMag)

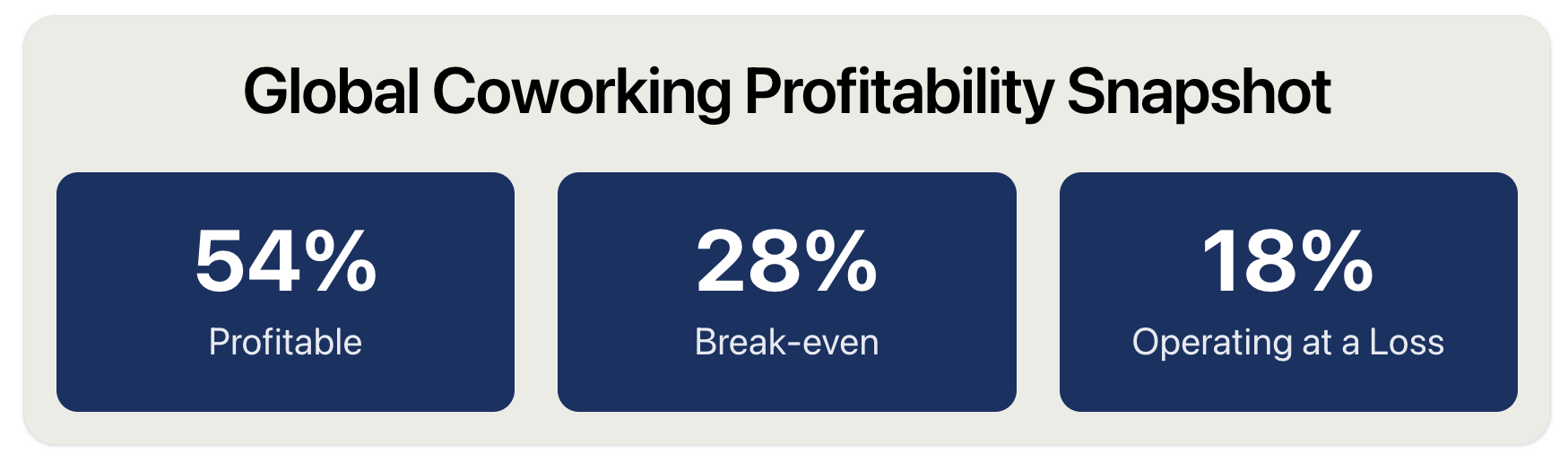

26. 54% of coworking space businesses worldwide are profitable, 28% break-even, and 18% are operating at a loss. (DeskMag)

27. The profitability of coworking spaces is up 35% compared to pre-COVID levels. (DeskMag)

28. More than 72% of coworking spaces become profitable after two years in operation. (DeskMag)

29. About 46% of coworking spaces report being “full” (near 100% occupancy) when mature. (Forbes)

30. 60% of operators cite rising operations costs and inflation as the most challenging market conditions. (The Instant Group)

31. 35% of operators identify driving leads as the biggest obstacle to revenue growth. (The Instant Group)

Coworking amenities and use of space

32. The U.S. accounts for 33.8% of all global office amenity searches. (The Instant Group)

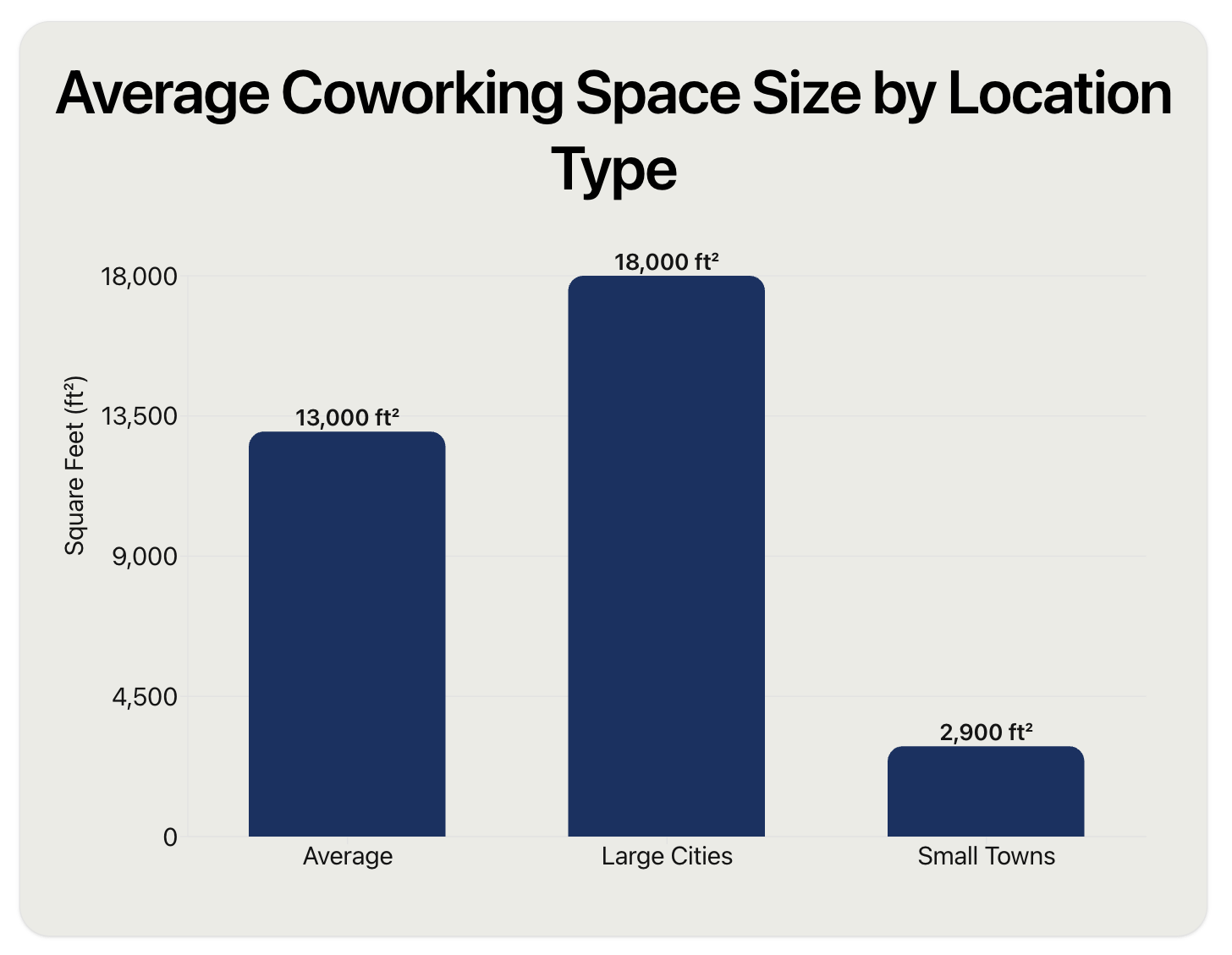

33. The average coworking space offers 90 desks across 13,000 ft² of space. (DeskMag)

34. In big cities, coworking spaces average 18,000+ ft², while in towns less than 20,000 people, a space averages just 2,900 ft². (DeskMag)

35. North America has the highest space per desk with an average over 155 ft² per desk. (DeskMag)

36. Coworking networks with 10+ locations have an average of 134 ft² per desk. (DeskMag)

37. Coworking spaces allocate 15-20% of space towards non-desk amenities (ie. lounge and event areas). (CBRE)

38. 17% of office space in new builds is now amenity space, representing a 54% increase from 2021. (CBRE)

Real estate and coworking spaces

39. More than 50% of coworking spaces in London open under management contracts as opposed to traditional leases. (Retail Dive)

40. 33% of landlords report a significant increase in demand for flexible space compared to traditional leases. (The Instant Group)

41. On average, coworking spaces are willing to allocate up to 43% of their capacity to one enterprise client. (DeskMag)

42. 33% of coworking space operators would not allocate more than 20% of their space to one client. (DeskMag)

43. 50% of companies plan to reduce traditional office space in the future and shift to hybrid or flexible models. (Reuters)

44. 50% of enterprise firms expected to close at least 25% of their offices and rely more on flex spaces. (IWG Workplace Survey)

45. 55% of global corporations now utilize flexible office solutions, and 17% plan to increase their use. (Cushman & Wakefield)

46. 56% of CBRE’s clients were using flex space and 43% anticipated needing more. (CBRE)

47. 67% of landlords plan to launch their own flex brand within two years. (The Instant Group)

Coworking and share of office space

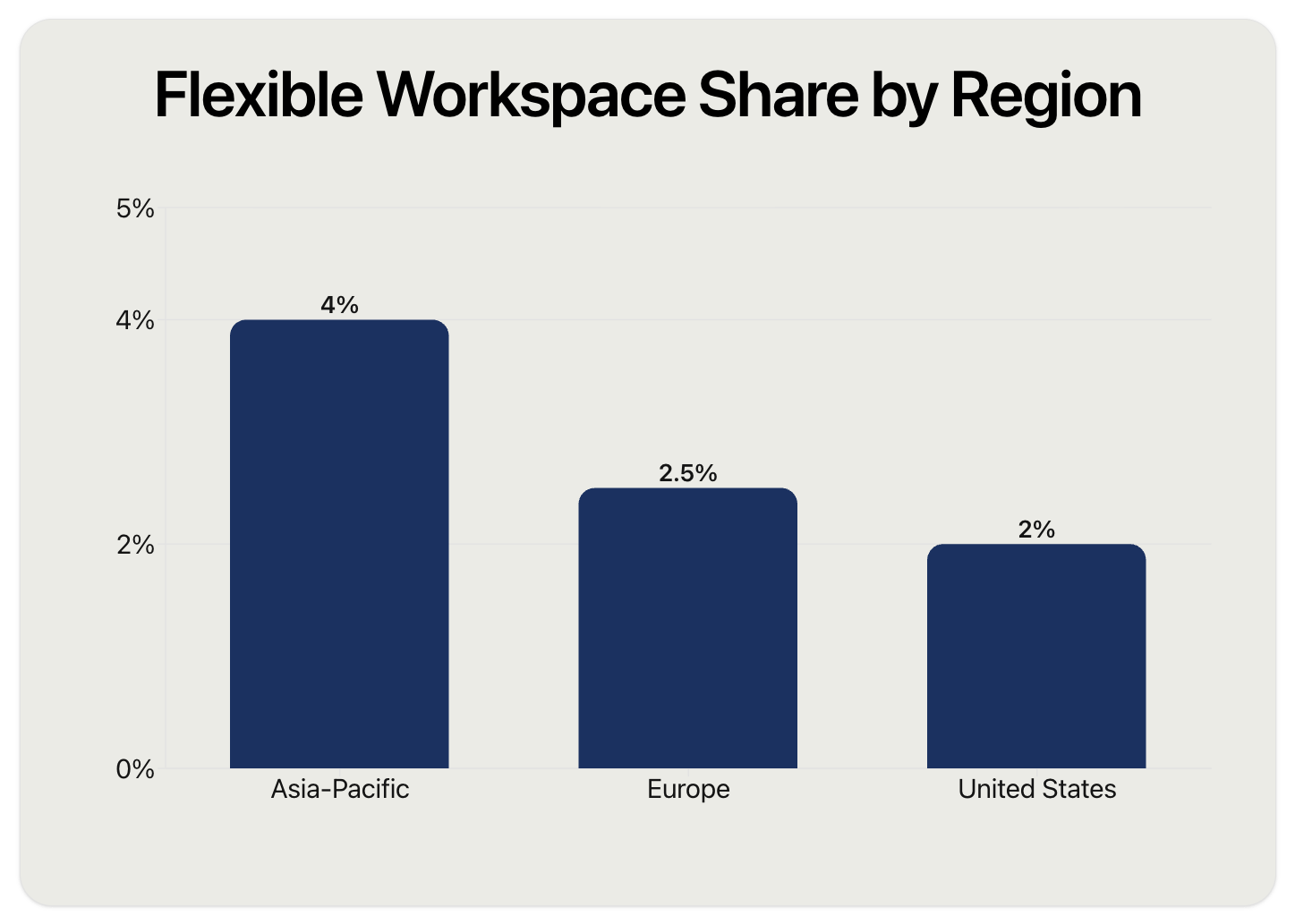

48. Asia-Pacific: 4% of total office space in Asia-Pacific is flexible workspace. (Allwork.space)

49. Europe: 2.5% of total office space in Europe is flexible workspace. (Allwork.space)

50. United States: 2% of total office space in the US is flexible workspace. (CoworkingCafe)

51. United States: Manhattan, NY is the largest coworking market in the US with 12 million ft² of flexible workspace. (Allwork.space)

Coworking space member demographics

52. Women now make up 46% of coworking members globally, a 15% increase from 2020. (Allwork.space)

53. Full-time coworking members typically use the space 2-3 days per week, while dedicated office users come daily. (Allwork.space)

54. 84% of remote workers say coworking spaces make them feel more engaged. (GCUC)

55. 55% of coworkers stick with the same space long-term. (CoworkingResources)

56. The average coworking member is 36 years old. (Allwork.space)

57. The top reasons people join coworking spaces are community, networking, and schedule flexibility. (Allwork.space)

58. 65% of coworking space members are Millennials. (Allwork.space)

Automation and technology use in coworking spaces

59. 88% of coworking space operators say automating manual tasks in their space is “Important” or “Very Important”. (Optix)

60. Coworking space operators are spending on average 63% of their time in technology tools. (Optix)

61. Community managers are spending on average 57% of their time in technology tools. (Optix)

62. Coworking space operators are spending on average 53% of their time performing manual tasks each day. (Optix)

63. The number one reason why coworking space operators implement automation is to increase operational efficiency. (Optix)

64. 62% of coworking operators wish they had more time to build community. (Optix)

65. 67% of coworking space operators are using on average 4 different technology tools to run their business. (Optix)

Sources:

Coworking Spaces Market (2024 – 2030), 2024

Coworking Spaces Market, 2025

The office: Elevated, 2022

Coworking Spaces May Be the Answer to Retailers’ Foot Traffic Problem, 2018

U.S. Coworking Industry Report Q3 ’25: Coworking Covers 152 Million Sq. Ft. Across 8,400+ Locations, 2025

Coworking Industry Report Q3 2025: More than 4,300 Flexible Workspaces in the UK and Ireland, 2025

List of Coworking spaces in Canada, 2025

Cowork Space in Australia – Market Research Report (2014-2029), 2024

Worldwide Coworking Statistics [2022], 2022

Top Coworking Statistics in India and Globally: 2023 and Beyond, 2023

Coworking By The Numbers: 2024 Data And Trends That Offer Insights Into The Future Of Flex, 2024

More Profitable Coworking Spaces Now Than Pre-Covid, 2025

Global Flexible Office Trends 2025, 2025

Price Guide for Flexible Offices in Sydney, 2022

Coworking Spaces Surge Across UK and Ireland as Demand and Prices Climb in 2025, 2025

Canada’s Coworking Market: Pricing, Trends & Growth [2025], 2025

One Big Potential Beneficiary Of The Coworking Space Trend: Brick-And-Mortar Retailers, 2018

2023 North America State of the Market for Flexible Workspace Providers, 2023

What Coworking Spaces Look Like Today – The Latest Figures, 2025

Effective Spaces, 2025

Big Global Employers Plan Modest Cuts to Office Space: Knight Frank, 2023

The IWG Global Workspace Survey, 2019

How Flex Space Will Thrive in a Hybrid World, 2021

GCUC, 2021

Global Coworking Growth Study 2020, 2020

The State of Automation in Coworking and Flex Spaces 2024, 2024

Kelly Karn is the Marketing Manager at Optix coworking software. She's been covering the latest and greatest in the world of coworking for 4 years and is one of the leading voices in coworking content having written over 300 articles. You can find her work on Coworking Insights, Coworking Resources, Allwork.space, DeskMag, GCUC, and (of course) the Optix blog.