TL;DR

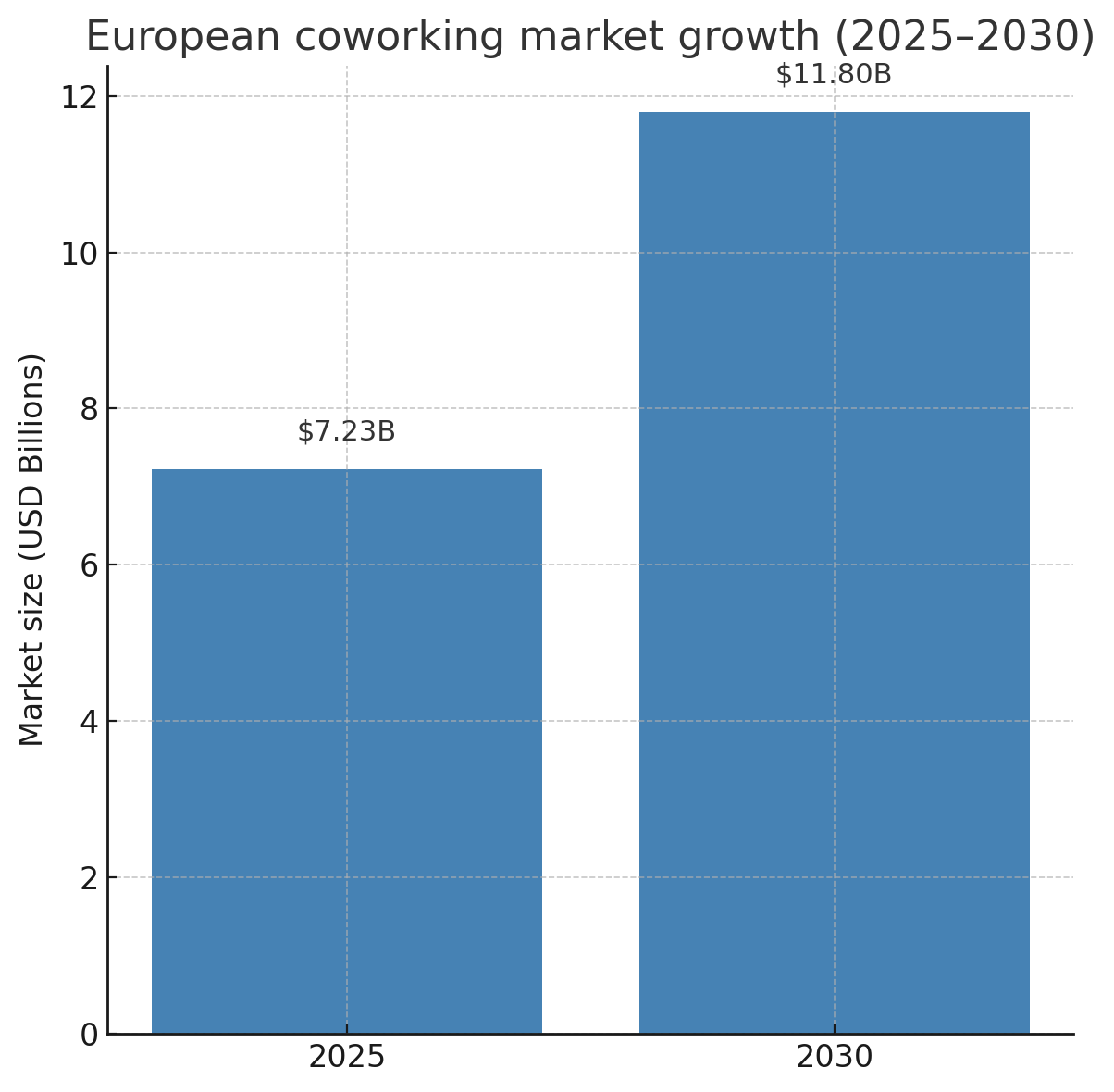

- Europe’s coworking sector is valued at USD 7.23B in 2025, projected to reach USD 11.8B by 2030 at a 10.37% CAGR, making it a core part of the office ecosystem

- With 80–85% average occupancy, coworking spaces consistently outperform traditional offices, driven by hybrid work, SMEs, and freelancers

- Secondary cities (Lisbon, Manchester, Krakow, Prague) are seeing faster growth and strong demand, while pricing varies widely — from €325/month in Barcelona to €1,700/month in Paris

Once considered a niche solution for startups and freelancers, coworking has become a cornerstone of Europe’s office landscape. By 2025, the sector is valued at USD 7.23 billion and projected to nearly double to USD 11.8 billion by 2030, reflecting a 10.37% CAGR.

Flexible workspaces now represent around 2.5% of Europe’s total office stock, with pioneering markets like London reaching double-digit penetration — and there’s no signs of it slowing down.

In this article, we’ll walk through key information regarding the thriving European coworking market including the size of the European coworking market, growth drivers, and key opportunities for operators to consider.

- How big is the European coworking market in 2025?

- What’s driving the growth of the European coworking market?

- How many coworking spaces are there across Europe?

- Top European coworking markets by number of spaces

- Pricing benchmarks for European coworking spaces

- Occupancy rates and utilization of coworking spaces in Europe

- Comparison of the coworking market in different regions across Europe

- Future outlook for European coworking (2025–2030)

How big is the European coworking market in 2025?

Over the past decade, coworking in Europe has evolved from a niche trend into a core pillar of the continent’s office landscape. By 2025, the European coworking market is valued at USD 7.23 billion and is projected to reach USD 11.8 billion by 2030, representing a compound annual growth rate (CAGR) of 10.37% over the forecast period.

Flexible workspaces now account for approximately 2.5% of total office stock in Europe, a figure that has steadily climbed since the early 2010s when coworking was still a fringe concept. The region is home to ~6,850 coworking spaces in 2025, growing at an average of 4.7% annually in recent years, despite pandemic-related disruptions.

What’s driving the growth of the European coworking market?

Several factors underpin the sustained expansion of coworking across the European market.

- Hybrid work adoption: Large enterprises and SMEs alike are turning to coworking to support satellite offices and “hub-and-spoke” workplace strategies

- Demand from startups and freelancers: Flexible terms and community benefits appeal to Europe’s growing independent workforce

- Decentralization: Operators are increasingly targeting secondary cities and suburban hubs, where demand is high and competition lighter

While the late 2010s were defined by hyper-expansion, the post-pandemic era is characterized by steady, sustainable growth. Operators are focusing on profitability, differentiated services, and strategic partnerships with landlords – a sign of an industry that has cemented its role in the broader real estate ecosystem.

How many coworking spaces are there across Europe?

The European coworking footprint has expanded dramatically over the past decade, with the total number of spaces reaching ~6,850 in 2025, up from just a fraction of that in 2015. This growth reflects both organic demand from startups, SMEs, and freelancers as well as corporate adoption of flexible space models.

While coworking penetration varies widely between countries and cities, several markets stand out as European leaders.

Running a coworking space? Let's chat.

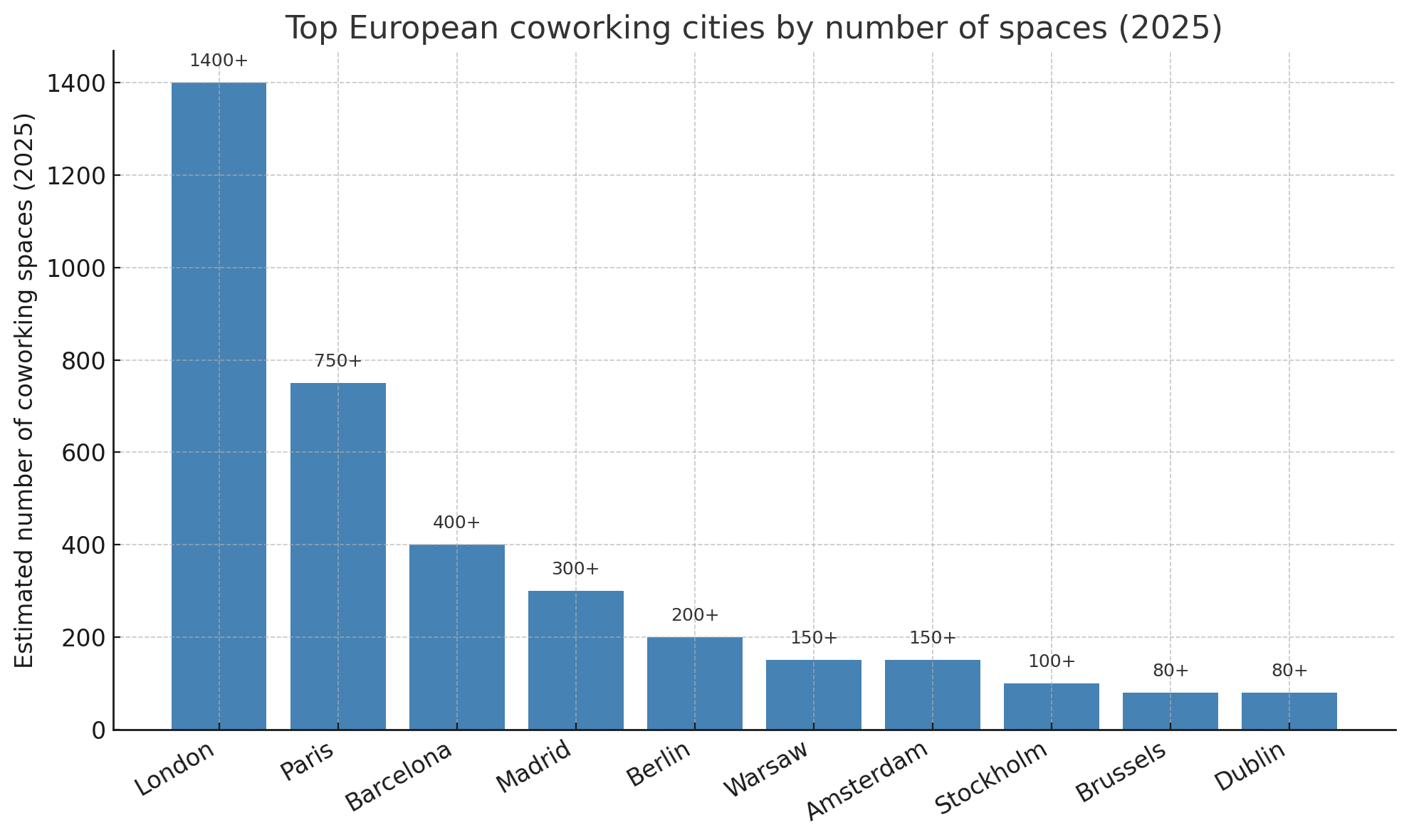

Top European coworking markets by number of spaces

Below are Europe’s largest coworking cities by estimated number of spaces in 2025, along with their market penetration as a share of total office stock:

| Rank | City | Estimated Spaces (2025) | Flex Space Penetration |

| 1 | London | 1,400+ | 10.1% |

| 2 | Paris | ~750 | 2-3% |

| 3 | Barcelona | ~400 | 3.5% |

| 4 | Madrid | ~300 | 1.9% |

| 5 | Berlin | 200+ | ~3% |

| 6 | Warsaw | 150+ | 4% |

| 7 | Amsterdam | 150+ | 4.8% |

| 8 | Stockholm | 100+ | 7% (CBD) |

| 9 | Dublin | 80+ | High take-up, <25 desk demand dominates |

| 10 | Brussels | ~80 | 3.4% |

The rise of secondary European coworking cities

While major capitals like London and Paris dominate in absolute numbers, secondary cities are seeing the fastest relative growth. Markets such as Lisbon, Manchester, Krakow, and Prague are attracting both local and international operators seeking less saturated, lower-cost environments — and in some cases, achieving higher occupancy rates than their capital city counterparts.

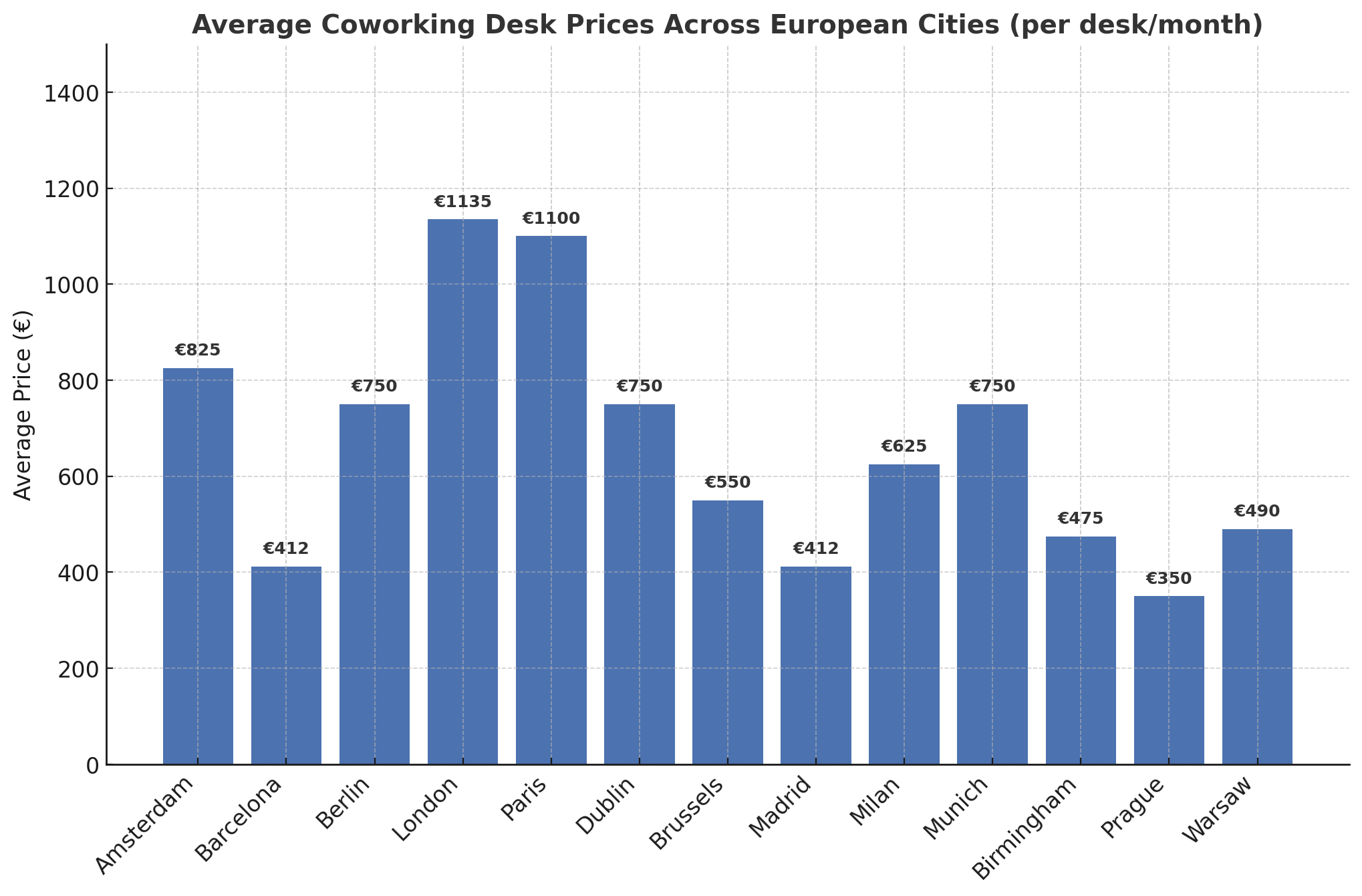

Pricing benchmarks for European coworking spaces

Coworking prices in Europe vary widely depending on location, quality, amenities, and market saturation. In prime capitals like London and Paris, premium desks can exceed €1,500 per month, while in cities such as Barcelona or Warsaw, comparable memberships can be a fraction of that cost.

Below are average monthly price ranges for a flex desk or hot desk membership as of Q4 2023:

| City | Price per Desk/Month |

| Amsterdam | €450 – €1,200 |

| Barcelona | €325 – €500 |

| Berlin | €600 – €900 |

| London | £500 – £1,500 (≈€570 – €1,700) |

| Paris | €500 – €1,700 |

| Dublin | €700 – €800 |

| Brussels | €400 – €700 |

| Madrid | €325 – €500 |

| Milan | €250 – €1,000 |

| Munich | €600 – €900 |

| Birmingham (UK) | £350 – £600 |

| Prague | €300 – €400 |

| Warsaw | €330 – €650 |

Key insights from pricing data

- Most expensive markets: London and Paris dominate the upper end, with prime-location desks reaching €1,700/month.

- Affordable hubs: Barcelona and Madrid remain among the most cost-effective major European cities, with averages as low as €325/month.

- Regional price convergence: Secondary cities are closing the gap with capitals. In some cases, smaller cities like Brighton (UK) have higher average dedicated desk rates than London, driven by strong local demand.

- Post-pandemic rebound: Many markets have not only recovered pre-2020 pricing but exceeded it, particularly for premium space.

Factors influencing coworking prices in Europe

- Location: prime CBD addresses command the highest rates.

- Amenities: premium services (on-site gyms, coffee bars, event spaces) drive price differentials.

- Operator brand: well-known operators can maintain higher rates due to brand reputation and global membership perks.

Local market dynamics: in oversupplied markets, competition caps pricing; in constrained markets, operators have more pricing power.

Occupancy rates and utilization of coworking spaces in Europe

One of the strongest indicators of the European coworking sector’s resilience is its consistently high occupancy rates, especially when compared to traditional office spaces.

Across Europe, average coworking occupancy ranges between 80–85%, significantly outperforming the ~60% post-pandemic physical occupancy seen in conventional offices.

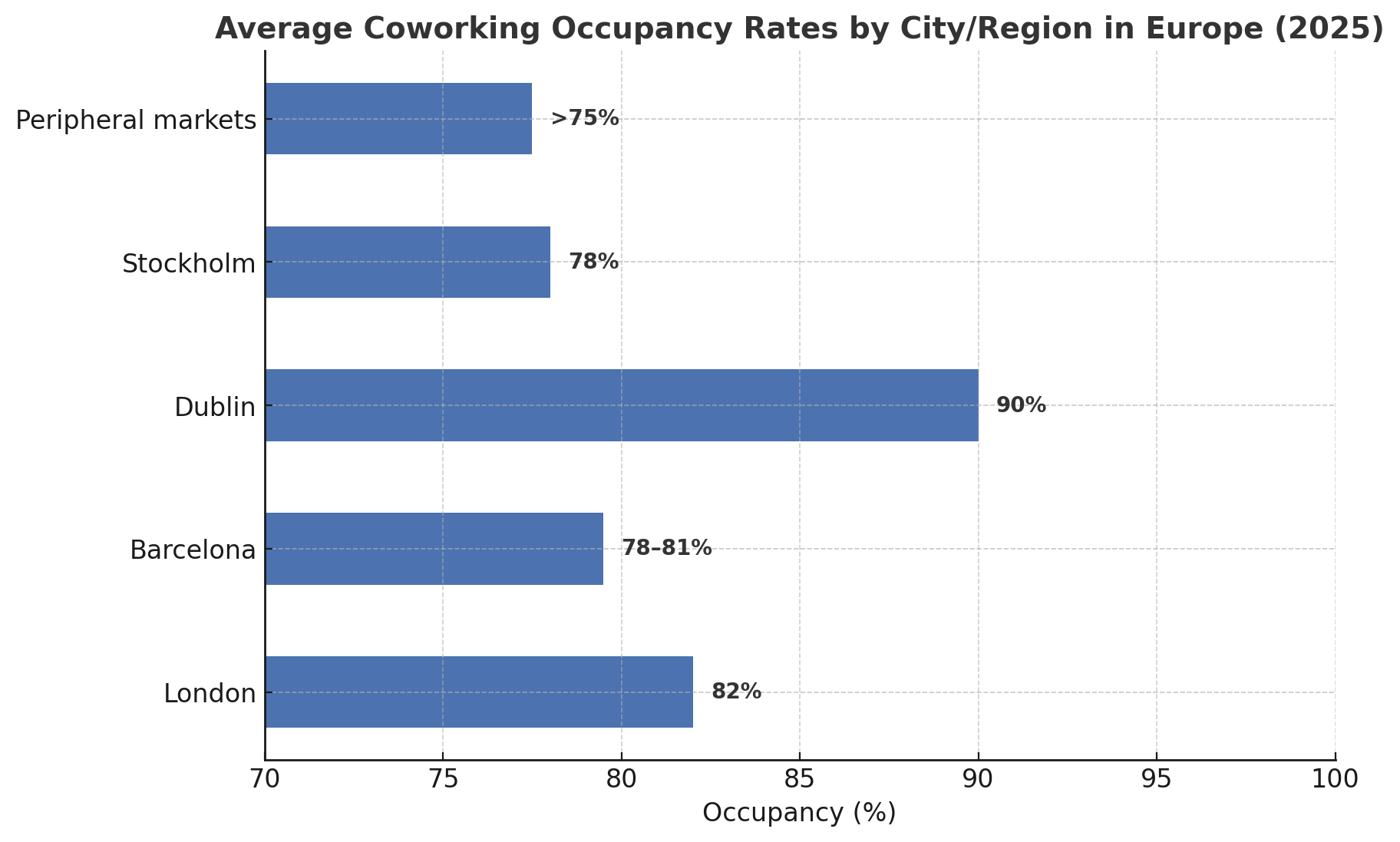

Key city-level occupancy benchmarks in Europe

| City / Region | Average Occupancy | Notes |

| London | ~82% | Slight dip from pre-pandemic highs due to new supply, but rates remain strong. |

| Barcelona | 78–81% | Demand supported by startups, remote workers, and affordability. |

| Dublin | Above conventional office occupancy | 82% of demand is for offices ≤25 desks, keeping small-unit occupancy high. |

| Stockholm | Slight decline in 2024 | Due to consolidation and new supply entering the market. |

| Peripheral markets (e.g., Lisbon, smaller Nordic cities) | Often >75% | Limited supply and strong remote work adoption keep utilization high. |

Why coworking outperforms traditional offices in utilization in Europe

- Agility of demand: coworking operators serve a mix of corporate teams, SMEs, and freelancers, allowing them to backfill vacancies faster than landlords reliant on multi-year leases.

- Hybrid work alignment: many companies now overbook flexible desks to accommodate staff rotation, meaning a single desk may serve multiple employees across a week.

- Diverse membership models: revenue comes not only from physical desks but also from virtual memberships, meeting rooms, and event space bookings.

Post-pandemic rebound

After a sharp drop in 2020, the sector saw a robust recovery. By late 2021, hybrid work adoption had driven renewed demand, and by 2023 most European coworking hubs were operating near full capacity in prime locations.

Even in oversupplied markets, operators have adapted by pausing expansion, consolidating locations, and focusing on retention strategies to keep utilization steady.

Comparison of the coworking market in different regions across Europe

Europe’s coworking market is far from uniform. Adoption rates, pricing, and growth patterns vary significantly between regions, influenced by local economic conditions, real estate dynamics, and work culture.

Western Europe: Established and competitive

- United Kingdom: The UK is the largest coworking market in Europe, with ~2,800 spaces (2024) and London alone accounting for 10.1% of the city’s total office stock in flexible space. London remains the most expensive European coworking city, with hot desks ranging from £500–£1,500/month (€570–€1,700).

- France: Paris has ~750 coworking spaces and premium rates up to €1,700/month. Flex penetration is 2–3%, but demand is growing steadily, driven by corporate adoption and limited supply in prime districts.

- Germany: With ~1,800 spaces projected in 2025, Germany is Europe’s second-largest coworking market by space count. Berlin leads with 200+ locations, followed by Munich, Hamburg, and Frankfurt.

- Netherlands: Amsterdam boasts one of Europe’s highest flex space penetrations at 4.8%, home to both global brands and innovative local operators like Spaces (founded here before being acquired by IWG).

Southern Europe: Fast growth and affordability

- Spain: Now among the top European countries by number of spaces (~1,400 in 2025), with Barcelona (3.5% penetration) and Madrid (1.9%) as main hubs. Barcelona alone added 2,300+ desks in Q1 2024. Prices are some of the lowest in major European markets (€325–€500/month).

- Italy: Growth is concentrated in Milan, with increasing corporate uptake and international chains like Talent Garden and WeWork expanding their footprint.

- Portugal: Lisbon and Porto have thriving coworking scenes, bolstered by digital nomads and remote workers, with occupancy often above 75%.

Nordics: Design-led and consolidating

- Sweden: Stockholm’s flex space penetration is ~7% of central office stock, quadrupling between 2017 and 2024. However, 2024 saw the first slight net decrease in sites as operators consolidated underperforming locations.

- Denmark & Finland: Copenhagen and Helsinki have smaller but growing coworking sectors, often dominated by local premium operators such as UMA Workspace and Epicenter.

- Norway: Oslo features a mix of boutique spaces and larger chains, with high-quality design as a differentiator.

Central & Eastern Europe (CEE): Rapid expansion stage

- Poland: Warsaw leads with 4% penetration of total office stock, boosted by both global brands and strong local operators.

- Czechia: Prague holds ~3% penetration, with a growing mix of boutique spaces and international operators.

- Hungary & Baltics: Budapest sits at 2–3% penetration, while Tallinn and Riga host vibrant startup-focused coworking communities.

- Growth pace: In 2023, CEE was the fastest-growing region in Europe for new coworking supply, with a +21% increase in new openings compared to declines in Western Europe.

Future outlook for European coworking (2025–2030)

The next five years are set to be a defining period for Europe’s coworking and flexible office sector. Industry forecasts from JLL and CBRE suggest that 20–30% of all office space could be flexible in nature by 2030, up from ~2–5% today.

Key drivers of future growth

- Hybrid work as the new norm: corporations are expected to further reduce traditional lease commitments in favor of flexible contracts, making coworking a core part of portfolio strategies.

- Corporate adoption of “hub-and-spoke” models: regional satellite offices in coworking hubs will allow companies to better serve distributed teams.

- Demand from SMEs and freelancers: flexible space offers scalability, community, and cost efficiency, especially in volatile economic environments.

- Urbanization and demographic trends: with over 70% of Europe’s population living in urban areas, demand for conveniently located, well-equipped workspaces will remain strong.

Emerging trends to watch

- Coliving + coworking hybrids: popular in Southern Europe and tourist-friendly cities, blending accommodation and workspace for remote workers and digital nomads.

- Wellness-integrated workspaces: expect more operators to offer gyms, meditation rooms, and wellness programs as differentiators.

- Industry-specific coworking: niche spaces tailored for sectors like biotech, design, or legal professionals.

- Suburban and secondary city growth: operators targeting less saturated areas with high remote worker populations.

Potential challenges

- Economic headwinds: recessionary trends or interest rate fluctuations could slow expansion plans or pressure pricing.

- Remote work policy shifts: if large corporates revert to primarily office-based work, demand for flex space could soften in some markets.

- Operator sustainability: profitability remains a focus, with overexpansion risks now carefully monitored after lessons learned pre-2020.

Coworking has become an integral part of corporate real estate strategies across Europe. The period from 2025 to 2030 will likely see the sector deepen its penetration, diversify its formats, and play a key role in shaping the future of work on the continent.

The European coworking industry is growing

The European coworking and flexible office market is no longer a niche but a vital part of the continent’s commercial real estate landscape.

With market value climbing steadily toward USD 11.8 billion by 2030, strong occupancy rates well above traditional offices, and growing adoption across both major cities and regional hubs, the sector is positioned for sustained growth.

As hybrid work models mature, demand from SMEs, freelancers, and corporations alike will continue to drive expansion, with flexible space expected to account for up to 30% of Europe’s office stock in the coming years.

Run your coworking space with Optix.

Frequently asked questions

The European coworking market is worth USD 7.23 billion in 2025 and is projected to grow to USD 11.8 billion by 2030, reflecting steady demand from startups, SMEs, freelancers, and corporations.

Coworking now makes up around 2.5% of Europe’s total office stock, with leading cities like London reaching 10%+ penetration in flexible workspace.

London leads with 1,400+ spaces, followed by Paris (~750), Barcelona (~400), and Berlin (200+). Secondary hubs like Lisbon, Krakow, and Manchester are experiencing rapid growth.

Prices vary widely. On average, Barcelona and Madrid offer desks from €325/month, while London and Paris can exceed €1,700/month for premium locations.

Coworking spaces operate at 80–85% average occupancy, significantly higher than conventional offices (~60%). Smaller office units (<25 desks) see especially strong demand.